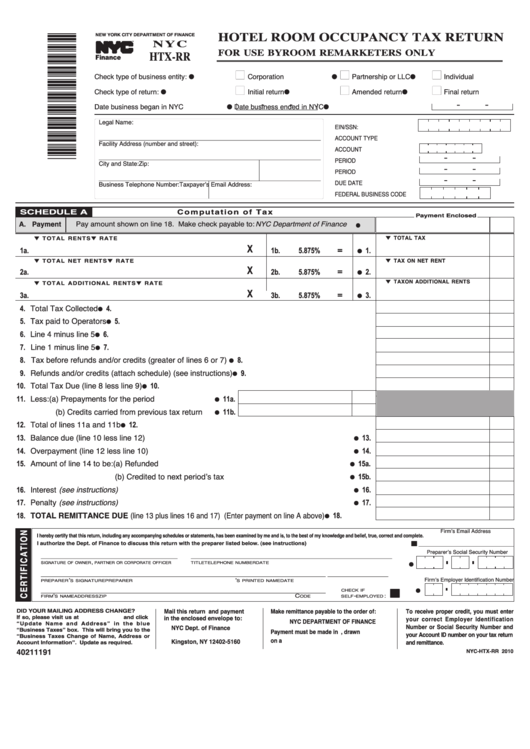

Form Nyc-Htx-Rr - Hotel Room Occupancy Tax Return For Use By Room Remarketers Only

ADVERTISEMENT

HOTEL ROOM OCCUPANCY TAX RETURN

NEW YORK CITY DEPARTMENT OF FINANCE

TM

N Y C

FOR USE BY ROOM REMARKETERS ONLY

HTX-RR

Finance

I

I

I

G

G

Check type of business entity:.....................G

Corporation

Partnership or LLC

Individual

I

I

I

G

G

Check type of return: ...................................G

Initial return

Amended return

Final return

-

-

-

-

Date business ended in NYC G

Date business began in NYC ........................G

Legal Name:

EIN/SSN: .....................................

____________________________________________________________________________

ACCOUNT TYPE ........................ HOTEL TAX

Facility Address (number and street):

ACCOUNT ID ..............................

-

-

____________________________________________________________________________

PERIOD BEGINNING..................

City and State:

Zip:

-

-

PERIOD ENDING........................

____________________________________________________________________________

-

-

DUE DATE ..................................

Business Telephone Number:

Taxpayerʼs Email Address:

FEDERAL BUSINESS CODE .....

SCHEDULE A

C o m p u t a t i o n o f T a x

Payment Enclosed

A. Payment

Pay amount shown on line 18. Make check payable to: NYC Department of Finance

G

M TOTAL TAX

M T O T A L R E N T S

M R A T E

X

1a.

1b.

5.875%

=

1.

G

M TAX ON NET RENT

M T O T A L N E T R E N T S

M R A T E

X

2a.

2b.

5.875%

=

2.

G

M TAX ON ADDITIONAL RENTS

M T O T A L A D D I T I O N A L R E N T S

M R A T E

X

3a.

3b.

5.875%

=

3.

G

4. Total Tax Collected

4.

G

....................................................................................................................................................................................................................

5. Tax paid to Operators

5.

G

.............................................................................................................................................................................................................

6. Line 4 minus line 5

6.

G

................................................................................................................................................................................................................................................................

.........

7. Line 1 minus line 5

7.

G

......................................................................................................................................................................................................................

8. Tax before refunds and/or credits (greater of lines 6 or 7)

8.

G

.......................................................................................................

9. Refunds and/or credits (attach schedule) (see instructions)

9.

G

.....................................................................................................

10. Total Tax Due (line 8 less line 9)

10.

G

..............................................................................................................................................................................

11. Less: (a) Prepayments for the period

11a.

G

..........................................

11b.

G

(b) Credits carried from previous tax return

........

12. Total of lines 11a and 11b

12.

G

..............................................................................................................................................................................................

13. Balance due (line 10 less line 12)

13.

G

........................................................................................................................................................................

14. Overpayment (line 12 less line 10)

14.

G

.....................................................................................................................................................................

15. Amount of line 14 to be: (a) Refunded

15a.

G

.........................................................................................................................................................

15b.

(b) Credited to next periodʼs tax

G

....................................................................................................

16. Interest (see instructions)

16.

G

................................................................................................................................................................................................

17. Penalty (see instructions)

17.

G

................................................................................................................................................................................................

18. TOTAL REMITTANCE DUE (line 13 plus lines 16 and 17) (Enter payment on line A above)

18.

G

.....................

Firmʼs Email Address

I hereby certify that this return, including any accompanying schedules or statements, has been examined by me and is, to the best of my knowledge and belief, true, correct and complete.

I I

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .............................................................YES

_______________________________

Preparerʼs Social Security Number

____________________________________

___________________

__________________

________________

,

SIGNATURE OF OWNER

PARTNER OR CORPORATE OFFICER

TITLE

TELEPHONE NUMBER

DATE

G

_________________________________________

__________________________________

________________

Firmʼs Employer Identification Number

ʼ

ʼ

PREPARER

S SIGNATURE

PREPARER

S PRINTED NAME

DATE

I I

G

_____________________________

________________________________

______________

CHECK IF

ʼ

C

-

:

FIRM

S NAME

ADDRESS

ZIP

ODE

SELF

EMPLOYED

DID YOUR MAILING ADDRESS CHANGE?

Mail this return and payment

Make remittance payable to the order of:

To receive proper credit, you must enter

If so, please visit us at nyc.gov/finance and click

in the enclosed envelope to:

your correct Employer Identification

NYC DEPARTMENT OF FINANCE

“Update Name and Address” in the blue

Number or Social Security Number and

NYC Dept. of Finance

“Business Taxes” box. This will bring you to the

Payment must be made in U.S. dollars, drawn

your Account ID number on your tax return

P.O. Box 5160

“Business Taxes Change of Name, Address or

on a U.S. bank.

Kingston, NY 12402-5160

Account Information”. Update as required.

and remittance.

40211191

NYC-HTX-RR 2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4