Summary Schedule Tc - Tax Credits

Download a blank fillable Summary Schedule Tc - Tax Credits in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Summary Schedule Tc - Tax Credits with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

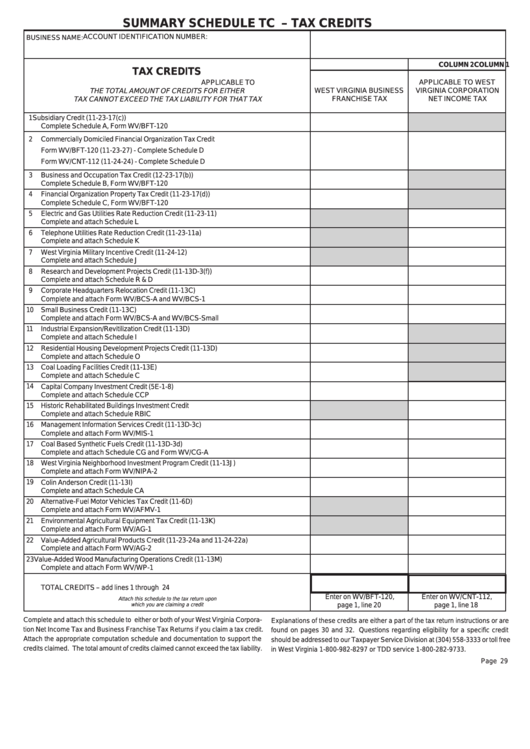

SUMMARY SCHEDULE TC – TAX CREDITS

ACCOUNT IDENTIFICATION NUMBER:

BUSINESS NAME:

COLUMN 1

COLUMN 2

TAX CREDITS

APPLICABLE TO

APPLICABLE TO WEST

THE TOTAL AMOUNT OF CREDITS FOR EITHER

WEST VIRGINIA BUSINESS

VIRGINIA CORPORATION

FRANCHISE TAX

NET INCOME TAX

TAX CANNOT EXCEED THE TAX LIABILITY FOR THAT TAX

1

Subsidiary Credit (11-23-17(c))

Complete Schedule A, Form WV/BFT-120

2

Commercially Domiciled Financial Organization Tax Credit

Form WV/BFT-120 (11-23-27) - Complete Schedule D

Form WV/CNT-112 (11-24-24) - Complete Schedule D

3

Business and Occupation Tax Credit (12-23-17(b))

Complete Schedule B, Form WV/BFT-120

4

Financial Organization Property Tax Credit (11-23-17(d))

Complete Schedule C, Form WV/BFT-120

5

Electric and Gas Utilities Rate Reduction Credit (11-23-11)

Complete and attach Schedule L

6

Telephone Utilities Rate Reduction Credit (11-23-11a)

Complete and attach Schedule K

7

West Virginia Military Incentive Credit (11-24-12)

Complete and attach Schedule J

8

Research and Development Projects Credit (11-13D-3(f))

Complete and attach Schedule R & D

9

Corporate Headquarters Relocation Credit (11-13C)

Complete and attach Form WV/BCS-A and WV/BCS-1

10

Small Business Credit (11-13C)

Complete and attach Form WV/BCS-A and WV/BCS-Small

11

Industrial Expansion/Revitilization Credit (11-13D)

Complete and attach Schedule I

12

Residential Housing Development Projects Credit (11-13D)

Complete and attach Schedule O

13

Coal Loading Facilities Credit (11-13E)

Complete and attach Schedule C

14

Capital Company Investment Credit (5E-1-8)

Complete and attach Schedule CCP

15

Historic Rehabilitated Buildings Investment Credit

Complete and attach Schedule RBIC

16

Management Information Services Credit (11-13D-3c)

Complete and attach Form WV/MIS-1

17

Coal Based Synthetic Fuels Credit (11-13D-3d)

Complete and attach Schedule CG and Form WV/CG-A

18

West Virginia Neighborhood Investment Program Credit (11-13J)

Complete and attach Form WV/NIPA-2

19

Colin Anderson Credit (11-13I)

Complete and attach Schedule CA

20

Alternative-Fuel Motor Vehicles Tax Credit (11-6D)

Complete and attach Form WV/AFMV-1

21

Environmental Agricultural Equipment Tax Credit (11-13K)

Complete and attach Form WV/AG-1

22

Value-Added Agricultural Products Credit (11-23-24a and 11-24-22a)

Complete and attach Form WV/AG-2

23 Value-Added Wood Manufacturing Operations Credit (11-13M)

Complete and attach Form WV/WP-1

24

TOTAL CREDITS – add lines 1 through 23............................................................................

Enter on WV/BFT-120,

Enter on WV/CNT-112,

Attach this schedule to the tax return upon

page 1, line 20

page 1, line 18

which you are claiming a credit

Complete and attach this schedule to either or both of your West Virginia Corpora-

Explanations of these credits are either a part of the tax return instructions or are

tion Net Income Tax and Business Franchise Tax Returns if you claim a tax credit.

found on pages 30 and 32. Questions regarding eligibility for a specific credit

Attach the appropriate computation schedule and documentation to support the

should be addressed to our Taxpayer Service Division at (304) 558-3333 or toll free

credits claimed. The total amount of credits claimed cannot exceed the tax liability.

in West Virginia 1-800-982-8297 or TDD service 1-800-282-9733.

Page 29

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1