Maine Minimum Tax - 2001

ADVERTISEMENT

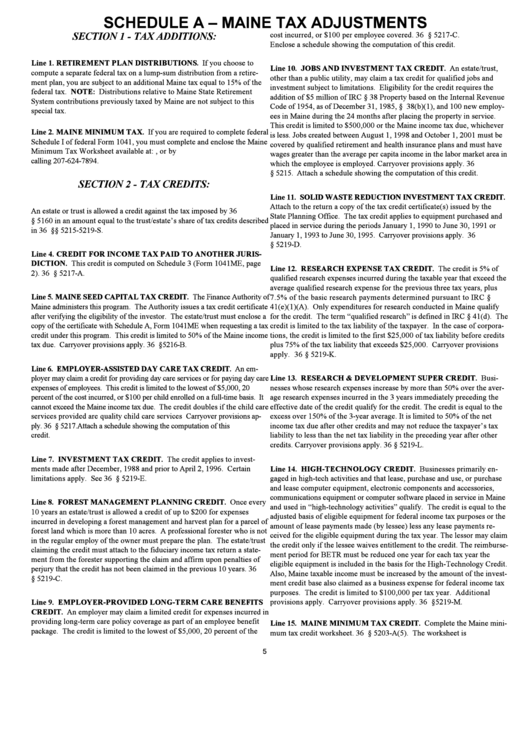

SCHEDULE A – MAINE TAX ADJUSTMENTS

cost incurred, or $100 per employee covered. 36 M.R.S.A. § 5217-C.

SECTION 1 - TAX ADDITIONS:

Enclose a schedule showing the computation of this credit.

Line 1. RETIREMENT PLAN DISTRIBUTIONS. If you choose to

Line 10. JOBS AND INVESTMENT TAX CREDIT. An estate/trust,

compute a separate federal tax on a lump-sum distribution from a retire-

other than a public utility, may claim a tax credit for qualified jobs and

ment plan, you are subject to an additional Maine tax equal to 15% of the

investment subject to limitations. Eligibility for the credit requires the

federal tax. NOTE: Distributions relative to Maine State Retirement

addition of $5 million of IRC § 38 Property based on the Internal Revenue

System contributions previously taxed by Maine are not subject to this

Code of 1954, as of December 31, 1985, § 38(b)(1), and 100 new employ-

special tax.

ees in Maine during the 24 months after placing the property in service.

This credit is limited to $500,000 or the Maine income tax due, whichever

Line 2. MAINE MINIMUM TAX. If you are required to complete federal

is less. Jobs created between August 1, 1998 and October 1, 2001 must be

Schedule I of federal Form 1041, you must complete and enclose the Maine

covered by qualified retirement and health insurance plans and must have

Minimum Tax Worksheet available at: , or by

wages greater than the average per capita income in the labor market area in

calling 207-624-7894.

which the employee is employed. Carryover provisions apply. 36 M.R.S.A.

§ 5215. Attach a schedule showing the computation of this credit.

SECTION 2 - TAX CREDITS:

Line 11. SOLID WASTE REDUCTION INVESTMENT TAX CREDIT.

Attach to the return a copy of the tax credit certificate(s) issued by the

An estate or trust is allowed a credit against the tax imposed by 36 M.R.S.A.

State Planning Office. The tax credit applies to equipment purchased and

§ 5160 in an amount equal to the trust/estate’s share of tax credits described

placed in service during the periods January 1, 1990 to June 30, 1991 or

in 36 M.R.S.A. §§ 5215-5219-S.

January 1, 1993 to June 30, 1995. Carryover provisions apply. 36 M.R.S.A.

§ 5219-D.

Line 4. CREDIT FOR INCOME TAX PAID TO ANOTHER JURIS-

DICTION. This credit is computed on Schedule 3 (Form 1041ME, page

Line 12. RESEARCH EXPENSE TAX CREDIT. The credit is 5% of

2). 36 M.R.S.A. § 5217-A.

qualified research expenses incurred during the taxable year that exceed the

average qualified research expense for the previous three tax years, plus

Line 5. MAINE SEED CAPITAL TAX CREDIT. The Finance Authority of

7.5% of the basic research payments determined pursuant to IRC §

Maine administers this program. The Authority issues a tax credit certificate

41(e)(1)(A). Only expenditures for research conducted in Maine qualify

after verifying the eligibility of the investor. The estate/trust must enclose a

for the credit. The term “qualified research” is defined in IRC § 41(d). The

copy of the certificate with Schedule A, Form 1041ME when requesting a tax

credit is limited to the tax liability of the taxpayer. In the case of corpora-

credit under this program. This credit is limited to 50% of the Maine income

tions, the credit is limited to the first $25,000 of tax liability before credits

tax due. Carryover provisions apply. 36 M.R.S.A. § 5216-B.

plus 75% of the tax liability that exceeds $25,000. Carryover provisions

apply. 36 M.R.S.A. § 5219-K.

Line 6. EMPLOYER-ASSISTED DAY CARE TAX CREDIT. An em-

ployer may claim a credit for providing day care services or for paying day care

Line 13. RESEARCH & DEVELOPMENT SUPER CREDIT. Busi-

expenses of employees. This credit is limited to the lowest of $5,000, 20

nesses whose research expenses increase by more than 50% over the aver-

percent of the cost incurred, or $100 per child enrolled on a full-time basis. It

age research expenses incurred in the 3 years immediately preceding the

cannot exceed the Maine income tax due. The credit doubles if the child care

effective date of the credit qualify for the credit. The credit is equal to the

services provided are quality child care services Carryover provisions ap-

excess over 150% of the 3-year average. It is limited to 50% of the net

ply. 36 M.R.S.A. § 5217. Attach a schedule showing the computation of this

income tax due after other credits and may not reduce the taxpayer’s tax

credit.

liability to less than the net tax liability in the preceding year after other

credits. Carryover provisions apply. 36 M.R.S.A. § 5219-L.

Line 7. INVESTMENT TAX CREDIT. The credit applies to invest-

ments made after December, 1988 and prior to April 2, 1996. Certain

Line 14. HIGH-TECHNOLOGY CREDIT. Businesses primarily en-

limitations apply. See 36 M.R.S.A. § 5219-E.

gaged in high-tech activities and that lease, purchase and use, or purchase

and lease computer equipment, electronic components and accessories,

communications equipment or computer software placed in service in Maine

Line 8. FOREST MANAGEMENT PLANNING CREDIT. Once every

and used in “high-technology activities” qualify. The credit is equal to the

10 years an estate/trust is allowed a credit of up to $200 for expenses

adjusted basis of eligible equipment for federal income tax purposes or the

incurred in developing a forest management and harvest plan for a parcel of

amount of lease payments made (by lessee) less any lease payments re-

forest land which is more than 10 acres. A professional forester who is not

ceived for the eligible equipment during the tax year. The lessor may claim

in the regular employ of the owner must prepare the plan. The estate/trust

the credit only if the lessee waives entitlement to the credit. The reimburse-

claiming the credit must attach to the fiduciary income tax return a state-

ment period for BETR must be reduced one year for each tax year the

ment from the forester supporting the claim and affirm upon penalties of

eligible equipment is included in the basis for the High-Technology Credit.

perjury that the credit has not been claimed in the previous 10 years. 36

Also, Maine taxable income must be increased by the amount of the invest-

M.R.S.A. § 5219-C.

ment credit base also claimed as a business expense for federal income tax

purposes. The credit is limited to $100,000 per tax year. Additional

provisions apply. Carryover provisions apply. 36 M.R.S.A. § 5219-M.

Line 9. EMPLOYER-PROVIDED LONG-TERM CARE BENEFITS

CREDIT. An employer may claim a limited credit for expenses incurred in

providing long-term care policy coverage as part of an employee benefit

Line 15. MAINE MINIMUM TAX CREDIT. Complete the Maine mini-

package. The credit is limited to the lowest of $5,000, 20 percent of the

mum tax credit worksheet. 36 M.R.S.A. § 5203-A(5). The worksheet is

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4