Instructions For Renewal Application - Fairfax County Department Of Tax Administration

ADVERTISEMENT

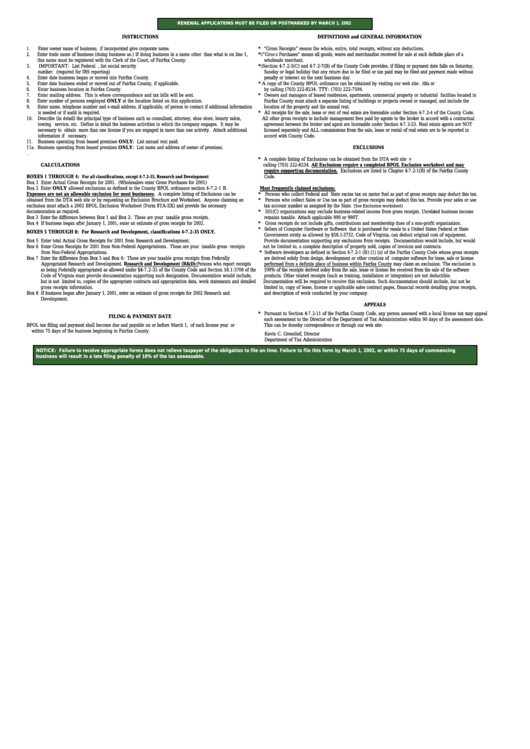

RENEWAL APPLICATIONS MUST BE FILED OR POSTMARKED BY MARCH 1, 2002

INSTRUCTIONS

DEFINITIONS and GENERAL INFORMATION

Enter owner name of business; if incorporated give corporate name.

* “Gross Receipts” means the whole, entire, total receipts, without any deductions.

1.

2.

Enter trade name of business (doing business as.) If doing business in a name other than what is on line 1,

* “Gross Purchases” means all goods, wares and merchandise received for sale at each definite place of a

this name must be registered with the Clerk of the Court, of Fairfax County.

wholesale merchant.

3.

IMPORTANT: List Federal I.D. number. If business does not have Federal I.D., list social security

* Section 4-7.2-3(C) and 4-7.2-7(B) of the County Code provides, if filing or payment date falls on Saturday,

number. (required for IRS reporting)

Sunday or legal holiday that any return due to be filed or tax paid may be filed and payment made without

4.

Enter date business began or moved into Fairfax County.

penalty or interest on the next business day.

5.

Enter date business ended or moved out of Fairfax County, if applicable.

* A copy of the County BPOL ordinance can be obtained by visiting our web site: or

6.

Enter business location in Fairfax County.

by calling (703) 222-8234. TTY: (703) 222-7594.

7.

Enter mailing address. This is where correspondence and tax bills will be sent.

* Owners and managers of leased residences, apartments, commercial property or industrial facilites located in

8.

Enter number of persons employed ONLY at the location listed on this application.

Fairfax County must attach a separate listing of buildings or projects owned or managed, and include the

9.

Enter name, telephone number and e-mail address, if applicable, of person to contact if additional information

location of the property and the annual rent.

is needed or if audit is required.

* All receipts for the sale, lease or rent of real estate are licensable under Section 4-7.2-4 of the County Code.

10.

Describe (in detail) the principal type of business such as consultant, attorney, shoe store, beauty salon,

All other gross receipts to include management fees paid by agents to the broker in accord with a contractual

towing service, etc. Define in detail the business activities in which the company engages. It may be

agreement between the broker and agent are licensable under Section 4-7.2-23. Real estate agents are NOT

necessary to obtain more than one license if you are engaged in more than one activity. Attach additional

licensed separately and ALL commissions from the sale, lease or rental of real estate are to be reported in

information if necessary.

accord with County Code.

11.

Business operating from leased premises ONLY: List annual rent paid.

11a. Business operating from leased premises ONLY: List name and address of owner of premises.

EXCLUSIONS

.

* A complete listing of Exclusions can be obtained from the DTA web site or by

CALCULATIONS

calling (703) 222-8234. All Exclusions require a completed BPOL Exclusion worksheet and may

require supporting documentation. Exclusions are listed in Chapter 4-7.2-1(B) of the Fairfax County

BOXES 1 THROUGH 4:

For all classifications, except 4 -7.2 -35, Research and Development

Code.

Box 1 Enter Actual Gross Receipts for 2001. (Wholesalers enter Gross Purchases for 2001)

Box 2 Enter ONLY allowed exclusions as defined in the County BPOL ordinance section 4-7.2-1 B.

Most frequently claimed exclusions:

Expenses are not an allowable exclusion for most businesses . A complete listing of Exclusions can be

* Persons who collect Federal and State excise tax on motor fuel as part of gross receipts may deduct this tax.

obtained from the DTA web site or by requesting an Exclusion Brochure and Worksheet. Anyone claiming an

* Persons who collect Sales or Use tax as part of gross receipts may deduct this tax. Provide your sales or use

exclusion must attach a 2002 BPOL Exclusion Worksheet (Form 8TA-EX) and provide the necessary

tax account number as assigned by the State.

(See Exclusion worksheet)

documentation as required.

* 501(C) organizations may exclude business-related income from gross receipts. Unrelated business income

Box 3 Enter the difference between Box 1 and Box 2: These are your taxable gross receipts.

remains taxable. Attach applicable 990 or 990T.

Box 4 If business began after January 1, 2001, enter an estimate of gross receipts for 2002.

* Gross receipts do not include gifts, contributions and membership dues of a non-profit organization.

* Sellers of Computer Hardware or Software that is purchased for resale to a United States Federal or State

BOXES 5 THROUGH 8: For Research and Development, classifications 4-7.2-35 ONLY.

Government entity as allowed by §58.1-3732, Code of Virginia, can deduct original cost of equipment.

Box 5 Enter total Actual Gross Receipts for 2001 from Research and Development.

Provide documentation supporting any exclusions from receipts. Documentation would include, but would

Box 6 Enter Gross Receipts for 2001 from Non-Federal Appropriations. These are your taxable gross receipts

not be limited to, a complete description of property sold, copies of invoices and contracts.

from Non-Federal Appropriations.

* Software developers as defined in Section 4-7.2-1 (B) (1) (z) of the Fairfax County Code whose gross receipts

Box 7 Enter the difference from Box 5 and Box 6: These are your taxable gross receipts from Federally

are derived solely from design, development or other creation of computer software for lease, sale or license

Appropriated Research and Development. Research and Development (R&D):Persons who report receipts

performed from a definite place of business within Fairfax County may claim an exclusion. The exclusion is

as being Federally appropriated as allowed under §4-7.2-35 of the County Code and Section 58.1-3706 of the

100% of the receipts derived soley from the sale, lease or license fee received from the sale of the software

Code of Virginia must provide documentation supporting such designation. Documentation would include,

products. Other related receipts (such as training, installation or integration) are not deductible.

but is not limited to, copies of the appropriate contracts and appropriation data, work statements and detailed

Documentation will be required to receive this exclusion. Such documentation should include, but not be

gross receipts information.

limited to, copy of lease, license or applicable sales contract pages, financial records detailing gross receipts,

Box 8 If business began after January 1, 2001, enter an estimate of gross receipts for 2002 Research and

and description of work conducted by your company.

Development.

APPEALS

* Pursuant to Section 4-7.2-11 of the Fairfax County Code, any person assessed with a local license tax may appeal

FILING & PAYMENT DATE

such assessment to the Director of the Department of Tax Administration within 90 days of the assessment date.

BPOL tax filing and payment shall become due and payable on or before March 1, of each license year or

This can be done by correspondence or through our web site:

within 75 days of the business beginning in Fairfax County.

Kevin C. Greenlief, Director

Department of Tax Administration

NOTICE: Failure to receive appropriate forms does not relieve taxpayer of the obligation to file on time. Failure to file this form by March 1, 2002, or within 75 days of commencing

business will result in a late filing penalty of 10% of the tax assessable.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1