Form Boe-367-Sut - Filing Instructions For Sales And Use Tax Accounts On A Quarterly And Prepayment Filing Basis

ADVERTISEMENT

BOE-367-SUT (FRONT) REV. 3 (6-11)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

FILING INSTRUCTIONS FOR SALES AND USE TAX ACCOUNTS

ON A QUARTERLY AND PREPAYMENT FILING BASIS

(The following due dates do not apply to taxpayers filing on a special reporting basis.)

Prepayments of tax are due as follows:

FIRST, THIRD AND FOURTH CALENDAR QUARTERS

The first prepayment is due on or before the 24th day of the month following the first month of the quarter.

The second prepayment is due on or before the 24th day of the month following the second month of the quarter.

All prepayments in the first, third and fourth quarters must be an amount:

1.

not less than 90% of the tax liability for the month, or

2.

equal to one‑third (1/3) of the measure of tax liability reported for the corresponding quarterly period of the preceding year mul‑

tiplied by the tax rate in effect when prepayment is made, provided you or your predecessor were in business during all of the

quarter.

SECOND CALENDAR QUARTER

The first prepayment is due on or before May 24th. This prepayment is for the month of April and must be an amount:

1.

not less than 90% of the tax liability for the month of April, or

2.

equal to one‑third (1/3) of the measure of tax liability reported for the corresponding quarterly period of the preceding year mul‑

tiplied by the tax rate in effect when prepayment is made, provided you or your predecessor were in business during all of the

quarter.

The second prepayment is due on or before JUNE 24th. This prepayment is for the period of May 1 through June 15 and must be an

amount:

1.

equal to 135% of the tax liability for May, or

2.

equal to 90% of the tax liability for May plus 90% of the tax liability for the first 15 days of June, or

3.

not less than one‑half (1/2) of the measure of tax liability reported for the corresponding quarterly period of the preceding year

multiplied by the tax rate in effect when prepayment is made, provided you or your predecessor were in business during all of the

quarter.

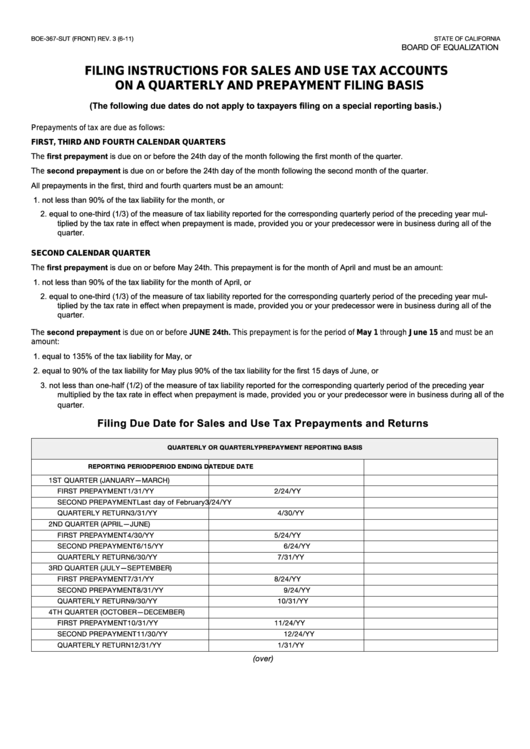

Filing Due Date for Sales and Use Tax Prepayments and Returns

QUARTERLY OR QUARTERLY PREPAYMENT REPORTING BASIS

REPORTING PERIOD

PERIOD ENDING DATE

DUE DATE

1ST QUARTER (JANUARY—MARCH)

FIRST PREPAYMENT

1/31/YY

2/24/YY

SECOND PREPAYMENT

Last day of February

3/24/YY

QUARTERLY RETURN

3/31/YY

4/30/YY

2ND QUARTER (APRIL—JUNE)

FIRST PREPAYMENT

4/30/YY

5/24/YY

SECOND PREPAYMENT

6/15/YY

6/24/YY

QUARTERLY RETURN

6/30/YY

7/31/YY

3RD QUARTER (JULY—SEPTEMBER)

FIRST PREPAYMENT

7/31/YY

8/24/YY

SECOND PREPAYMENT

8/31/YY

9/24/YY

QUARTERLY RETURN

9/30/YY

10/31/YY

4TH QUARTER (OCTOBER—DECEMBER)

FIRST PREPAYMENT

10/31/YY

11/24/YY

SECOND PREPAYMENT

11/30/YY

12/24/YY

QUARTERLY RETURN

12/31/YY

1/31/YY

(over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2