Virginia Pass-Through Entity Tax Payment Voucher

Pass-through entity tax payments may be made electronically. Visit the Department’s website

at for additional information and to make a payment.

How to Make Tax Payments Electronically

year and name and address information. Enter the date and

telephone number.

The Department provides two secure online options for

submitting withholding payments: eForms and Business

Compute the total income amount (including additions and

iFile. Payments are made by Debit EFT and you may

subtractions) on all nonresident owners based on the best

schedule your payment for a future date.

available information of their expected share of Virginia

A pass-through entity may also make its estimated tax

source income for 2013. Multiply the total income amount

payments using an ACH Credit transaction through its bank.

by 5% to determine the withholding tax due. Apply any tax

Some banks may charge a fee for this service. An Electronic

credits available to the nonresident owners’ withholding

Payment Guide is available at with

tax. The remaining amount of withholding tax is the amount

information on how to submit ACH Credit payments to the

due with the return. If the return is filed after the due date,

Department.

complete Page 2 of Form 502 to calculate any penalty and

interest due with the return.

Purpose of Form

Penalties

Use Form 502V to pay withholding tax, penalties and interest

when payment is made with Form 502. Form 502V should

Extension Penalty - The pass-through entity must pay at

only be used when sending a payment with the return.

least 90% of the withholding tax due by the return due date

to avoid a penalty. If the return is filed within the 6-month

When to File

extension and less than 90% of the tax was paid by the

The withholding tax payment is due on the due date of

original return due date, then the pass-through entity owes

the pass-through entity’s return regardless of whether the

an extension penalty. The penalty is 2% per month of the tax

extension to file Form 502 is used. For calendar year filers,

due with the return from the filing due date through the date

the withholding tax payment is due on April 15 following the

of payment, up to a maximum of 12%.

close of the pass-through entity’s taxable year.

Late Filing Penalty - If the return is filed after the extended

Where to File

due date, the extension is not valid, and the entity is subject

to the late filing penalty of 30% of the tax due or $1,200,

Mail returns and payments to:

whichever is greater.

Virginia Department of Taxation

P.O. Box 1500

Late Payment Penalty - If the return is filed within the

Richmond, VA 23218-1500

extended period and full payment is not included with the

return, the entity is subject to the late payment penalty of 6%

Questions

per month from the date the return is filed through the date

If you have any questions about this return, please call (804)

of payment, up to a maximum of 30%.

367-8037 or write to the Virginia Department of Taxation,

Interest

P.O. Box 1115, Richmond, Virginia 23218-1115.

Interest is due on any unpaid tax at the underpayment rate

Preparation of Voucher

under Internal Revenue Code § 6621, plus 2%, from the due

Complete the pass-through entity’s federal employer

date until the tax is paid.

identification number (FEIN), entity type, ending month and

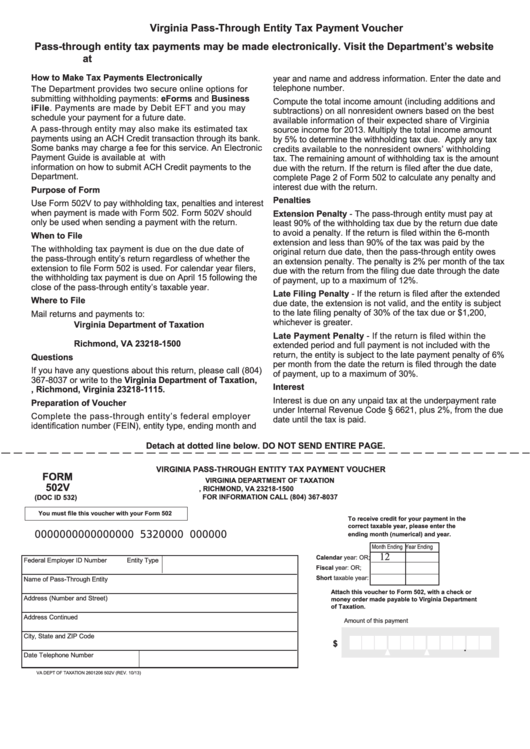

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

VIRGINIA PASS-THROUGH ENTITY TAX PAYMENT VOUCHER

FORM

VIRGINIA DEPARTMENT OF TAXATION

502V

P.O. BOX 1500, RICHMOND, VA 23218-1500

FOR INFORMATION CALL (804) 367-8037

(DOC ID 532)

You must file this voucher with your Form 502

To receive credit for your payment in the

correct taxable year, please enter the

0000000000000000 5320000 000000

ending month (numerical) and year.

Month Ending Year Ending

12

Calendar year:

OR;

Federal Employer ID Number

Entity Type

Fiscal year:

OR;

Short taxable year:

Name of Pass-Through Entity

Attach this voucher to Form 502, with a check or

Address (Number and Street)

money order made payable to Virginia Department

of Taxation.

Address Continued

Amount of this payment

City, State and ZIP Code

$

.

Date

Telephone Number

VA DEPT OF TAXATION 2601206 502V (REV. 10/13)

1

1