Page 6 of 7

Section 6 -

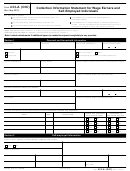

Monthly Household Income and Expense Information

(Continued)

Monthly Household Expenses

Enter your average monthly expenses.

Note: Expenses may be adjusted based on IRS Collection Financial Standards. The

standards may be found at irs.gov.

Food, clothing, and miscellaneous

.

(e.g., housekeeping supplies, personal care products , minimum payment on credit card)

A reasonable estimate of these expenses may be used.

(41) $

Housing and utilities

(e.g., rent or mortgage payment and average monthly cost of property taxes, home insurance,

maintenance, dues, fees and utilities including electricity, gas, other fuels, trash collection, water, cable television and internet,

(42) $

telephone, and cell phone).

Vehicle loan and/or lease payment(s)

(43) $

Vehicle operating costs

(e.g., average monthly cost of maintenance, repairs, insurance, fuel, registrations, licenses,

. A reasonable estimate of these expenses may be used.

(44) $

inspections, parking, tolls, etc.)

Public transportation costs

. A

(e.g., average monthly cost of fares for mass transit such as bus, train, ferry, taxi, etc.)

reasonable estimate of these expenses may be used.

(45) $

Health insurance premiums

(46) $

(e.g. average monthly cost of prescription drugs, medical services, and medical supplies like

Out-of-pocket health care costs

(47) $

eyeglasses, hearing aids, etc.)

Court-ordered payments

(48) $

(e.g., monthly cost of any alimony, child support, etc.)

Child/dependent care payments

(49) $

(e.g., daycare, etc.)

Life insurance premiums

(50) $

Current taxes

(51) $

(e.g., monthly cost of federal, state, and local tax, personal property tax, etc.)

Other secured debts

(e.g., any loan where you pledged an asset as collateral not previously listed, government guaranteed

.

(52) $

Student Loan)

Delinquent State and Local Taxes

(53) $

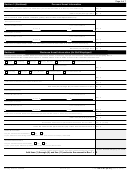

Box 4 Household Expenses

$

Add lines (41) through (53) and enter the amount in Box 4 =

Box 5 Remaining Monthly Income

$

Subtract Box 4 from Box 3 and enter the amount in Box 5 =

Section 7

Calculate Your Minimum Offer Amount

The next steps calculate your minimum offer amount. The amount of time you take to pay your offer in full will affect your minimum offer amount.

Paying over a shorter period of time will result in a smaller minimum offer amount.

If you will pay your offer in 5 months or less, multiply "Remaining Monthly Income" (Box 5) by 12 to get "Future Remaining Income" (Box 6).

Enter the total from Box 5 here

Box 6 Future Remaining Income

X 12 =

$

$

If you will pay your offer in more than 5 months, multiply "Remaining Monthly Income"

by 24 to get "Future Remaining Income" (Box 7).

(Box 5)

Enter the total from Box 5 here

Box 7 Future Remaining Income

X 24 =

$

$

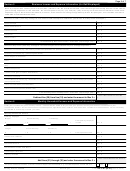

Determine your minimum offer amount by adding the total available assets from Box 1 to amount in either Box 6 or Box 7.

Enter the amount from Box 1 here

Enter the amount from either Box 6 or Box 7

Offer Amount

+

=

Do Not Enter a Number Less Than Zero

Must be more than zero

$

$

$

If you have special circumstances that would hinder you from paying this amount, explain them on Form 656,

Offer in Compromise, page 2, "Explanation of Circumstances."

433-A (OIC)

Catalog Number 55896Q

Form

(Rev. 5-2012)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28