Page 3 of 6

Section 2

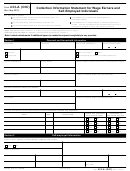

Business Asset Information

(Continued)

If the business owns more properties, vehicles, or equipment than shown in this form, please list on an attachment.

Real Estate

Do not use negative numbers.

(Buildings, Lots, Commercial Property, etc.)

Property Address

Date Purchased

Property Description

(Street Address, City, State, ZIP Code)

County and Country

Current Market Value

Less Loan Balance

(Mortgages, etc.)

$

X .8 = $

– $

Total Value of Real Estate = (3a) $

Property Address

Date Purchased

(Street Address, City, State, ZIP Code)

Property Description

County and Country

Current Market Value

Less Loan Balance

(Mortgages, etc.)

$

X .8 = $

– $

Total Value of Real Estate = (3b) $

Total value of property(s) listed from attachment [current market value X .8 less any loan balance(s)]

(3c) $

Add lines (3a) through (3c) =

(3)

$

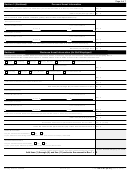

Business Vehicles

. If additional space is needed, list on an attachment.

(cars, boats, motorcycles, trailers, etc.)

Vehicle Make & Model

Year

Date Purchased

Mileage or Use Hours

Monthly Lease/Loan Amount

Lease

$

Loan

Current Market Value

Less Loan Balance

Total value of vehicle

(if the vehicle

$

X .8 = $

– $

is leased, enter 0 as the total value) =

(4a) $

Vehicle Make & Model

Year

Date Purchased

Mileage or Use Hours

Monthly Lease/Loan Amount

Lease

$

Loan

Current Market Value

Less Loan Balance

Total value of vehicle

(if the vehicle

$

X .8 = $

– $

is leased, enter 0 as the total value) =

(4b) $

Vehicle Make & Model

Year

Date Purchased

Mileage or Use Hours

Monthly Lease/Loan Amount

Lease

$

Loan

Current Market Value

Less Loan Balance

Total value of vehicle

(if the vehicle

$

X .8 = $

– $

is leased, enter 0 as the total value) =

(4c) $

Total value of vehicles listed from attachment [current market value X .8 less any loan balance(s)]

(4d) $

Add lines (4a) through (4d) =

(4)

$

Other Business Equipment

Current Market Value

Less Loan Balance

Total value of equipment

$

X .8 = $

– $

=

(if leased, enter 0 as the total value)

(5a) $

Total value of equipment listed from attachment [current market value X .8 less any loan balance(s)]

(5b) $

IRS allowed exemption for professional books and tools of trade - (5c) $ [4,290]

Total value of all business equipment =

(5)

$

Add lines (5a) and (5b) minus line (5c), if number is less than zero, enter zero =

Box 1 Available Equity in Assets

Do not include the amount on lines with a letter beside the number.

$

Add lines (1) through (5) and enter the amount in Box 1 =

433-B (OIC)

Catalog Number 55897B

Form

(Rev. 5-2012)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28