Page 4 of 6

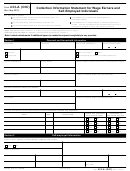

Section 3

Business Income Information

Enter the average gross monthly income of your business. To determine your gross monthly income use the most recent 6-12 months documentation

of commissions, invoices, gross receipts from sales/services, etc.; most recent 6-12 months earnings statements, etc., from every other source of

income (such as rental income, interest and dividends, or subsidies); or you may use a most recent 6-12 months Profit and Loss (P&L) to provide the

information of income and expenses.

Note: If you provide a current profit and loss statement for the information below, enter the total gross monthly income in Box 2 below. Do

not complete lines (6) - (10).

Gross receipts

(6)

$

Gross rental income

(7)

$

Interest income

(8)

$

Dividends

(9)

$

Other income (Specify on attachment)

(10) $

Box 2 Total Business Income

Add lines (6) through (10) and enter the amount in Box 2 =

$

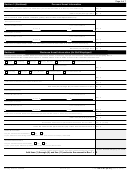

Section 4

Business Expense Information

Enter the average gross monthly expenses for your business using your most recent 6-12 months statements, bills, receipts, or other documents

showing monthly recurring expenses.

Note: If you provide a current profit and loss statement for the information below, enter the total monthly expenses in Box 3 below. Do not

complete lines (11) - (20).

Materials purchased (e.g., items directly related to the production of a product or service)

(11) $

Inventory purchased (e.g., goods bought for resale)

(12) $

Gross wages and salaries

(13) $

Rent

(14) $

Supplies (items used to conduct business and used up within one year, e.g., books, office supplies, professional

(15) $

equipment, etc.)

Utilities/telephones

(16) $

Vehicle costs (gas, oil, repairs, maintenance)

(17) $

Insurance (other than life)

(18) $

Current taxes (e.g., real estate, state, and local income tax, excise franchise, occupational, personal property,

sales and employer's portion of employment taxes, etc.)

(19) $

Other expenses (e.g., secured debt payments. Specify on attachment. Do not include credit card payments)

(20) $

Box 3 Total Business Expenses

Add lines (11) through (20) and enter the amount in Box 3 =

$

Box 4 Remaining Monthly Income

Subtract Box 3 from Box 2 and enter the amount in Box 4 =

If number is less than zero, enter zero.

$

433-B (OIC)

Catalog Number 55897B

Form

(Rev. 5-2012)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28