If you do not have sufficient cash to pay for your offer, you may need to consider

borrowing money from a bank, friends, and/or family. Other options may include

borrowing against or selling other assets. NOTE: If retirement savings from an

IRA or 401k plan are cashed out, there will be future tax liabilities owed as a

result. Contact the IRS or your tax advisor before taking this action.

Future tax obligations

If your offer is accepted, you must continue to file and pay your tax obligations

that become due in the future. If you fail to file and pay any tax obligations that

become due within the five years after your offer is accepted, your offer may

be defaulted. If your offer is defaulted, all compromised tax debts, including

penalties and interest, will be reinstated.

HOW TO APPLY

Application process

The application involves sending:

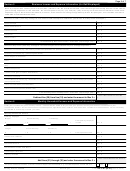

• Form 656 (Offer in Compromise)

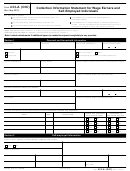

• Completed Form 433-A (OIC), Collection Information Statement for Wages

Earners and Self-Employed Individuals, if applicable

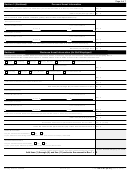

• Completed Form 433-B(OIC), Collection Information Statement for Busi-

nesses, if applicable

• $150 application fee, unless you meet low income certification

• Initial offer payment, unless you meet low income certification

If you and your spouse owe

If you have joint tax debt(s) with your spouse and also have an individual tax

joint and separate tax debts

debt(s), you and your spouse will send in one Form 656 with all of the joint tax

debt(s) and a second Form 656 with your individual tax debt(s), for a total of two

Forms 656.

If you and your spouse have joint tax debt(s) and you are also each responsible

for an individual tax debt(s), you will each need to send in a separate Form 656.

You will complete one Form 656 for yourself listing all your joint and separate

tax debts and your spouse will complete one Form 656 listing all his or her joint

and individual tax debts, for a total of two Forms 656.

If you and your spouse/ex-spouse have a joint tax debt and your spouse/

ex-spouse does not want to submit a Form 656, you on your own may submit a

Form 656 to compromise your responsibility for the joint debt.

Each Form 656 will require the $150 application fee and initial down payment

unless your household meets the Low Income Certification guidelines (See

page 2 of Form 656, Offer in Compromise).

COMPLETING THE APPLICATION PACKAGE

Step 1 – Gather your information

To calculate an offer amount, you will need to gather information about your

financial situation, including cash, investments, available credit, assets, income,

and debt.

You will also need to gather information about your average gross monthly

household income and expenses. The entire household includes spouse,

significant other, children, and others that reside in the household. This is

necessary for the IRS to accurately evaluate your offer. In general, the IRS

will not accept expenses for tuition for private schools, college expenses,

charitable contributions, and other unsecured debt payments as part of

the expenses calculation.

3

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28