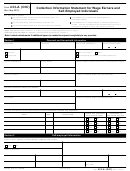

Step 2 – Fill out the Form 433-A

Fill out the Form 433-A(OIC) if you are an individual wage earner and/or a

(OIC), Collection Information State-

self-employed individual. This will be used to calculate an appropriate offer

ment for Wage Earners and Self-

amount based on your assets, income, expenses, and future earning potential.

Employed Individuals

You will have the opportunity to provide a written explanation of any special

circumstances that affect your financial situation.

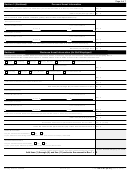

Step 3 – Fill out Form 433-B(OIC),

Fill out the Form 433-B(OIC) if your business is a Corporation, Partnership,

Collection Information Statement

Limited Liability Company (LLC) classified as a corporation, single member

for Businesses

LLC, or other multi-owner/multi-member LLC. This will be used to calculate an

appropriate offer amount based on your business assets, income, expenses,

and future earning potential. If you have assets that are used to produce income

(for example, a tow truck used in your business for towing vehicles), you may be

allowed to exclude equity in these assets.

Step 4 – Attach required documenta-

You will need to attach supporting documentation with Form(s) 433-A(OIC)

tion

and 433-B(OIC). A list of the documents required will be found at the end of

each form. Include copies of all required attachments, as needed. Do not send

original documents.

Note: A completed Form 433-A(OIC) and/or Form 433-B(OIC) must be included

with the Form 656 application.

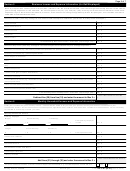

Step 5 – Fill out Form 656, Offer in

Fill out Form 656. The Form 656 identifies the tax years and type of tax you

Compromise

would like to compromise. It also identifies your offer amount and the payment

terms.

The Low Income Certification guidelines are included on Form 656. If you are

an individual and meet the guidelines, check the Low Income Certification box in

Section 4, on Form 656.

Step 6 – Include initial payment and

Include a check, cashier’s check, or money order for your initial payment based

$150 application fee

on the payment option you selected (20% of offer amount or first month’s install-

ment).

Include a separate check, cashier’s check, or money order for the application

fee ($150).

Make both payments payable to the “United States Treasury.” All payments must

be made in U.S. dollars.

If you meet the Low Income Certification guidelines, the initial payment and

application fee are not required.

Make a copy of your application package and keep it for your records.

Step 7 – Mail the application

Mail the application package to the appropriate IRS facility. See page 23,

package

Application Checklist, for details.

IMPORTANT INFORMATION

After you mail your application,

File all federal tax returns you are legally required to file.

continue to:

Make all required federal estimated tax payments and tax deposits that are due

for current taxes, and make all required periodic offer payments.

Reply to IRS requests for additional information within the timeframe specified.

Failure to reply timely to requests for additional information could result in the

return of your offer without appeal rights.

4

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28