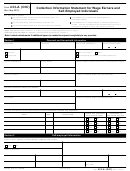

Department of the Treasury — Internal Revenue Service

433-A (OIC)

Form

Collection Information Statement for Wage Earners and

(Rev. May 2012)

Self-Employed Individuals

Use this form if you are

An individual who owes income tax on a Form 1040, U.S.

An individual who is personally responsible for a

Individual Income Tax Return

partnership liability

An individual with a personal liability for Excise Tax

An individual who is self-employed or has self-employment

income. You are considered to be self-employed if you are in

An individual responsible for a Trust Fund Recovery Penalty

business for yourself, or carry on a trade or business.

Wage earners Complete sections 1, 3, 4 (Box 1), 6, and 7 including signature line on page 7.

Self-employed individuals Complete all sections and signature line on page 7

Note: Include attachments if additional space is needed to respond completely to any question.

Section 1

Personal and Household Information

Last Name

First Name

Date of Birth

Social Security Number

(mm/dd/yyyy)

Do you:

Marital status

Home Address

(Street, City, State, ZIP Code)

Own your home

Rent

Married

Other

Unmarried

(specify e.g., share rent, live with relative, etc.)

Primary Phone

County of Residence

Mailing Address

(if different from above or Post Office Box number)

(

)

-

Secondary Phone

Fax Number

(

)

(

)

-

-

Employer's Name

Employer's Address

(Street, City, State, ZIP Code)

Occupation

How Long?

Provide information about your spouse.

Spouse's Last Name

First Name

Social Security Number

Date of Birth

(mm/dd/yyyy)

Occupation

Employer's Address

(Street, City, State, ZIP Code)

Employer's Name

Provide information for all other persons in the household or claimed as a dependent.

Claimed as a dependent

Contributes to

Name

Age

Relationship

on your Form 1040?

household income?

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

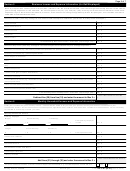

Section 2

Self-employed Information

If you or your spouse is self-employed, complete this section.

Is your business a sole proprietorship

?

(filing Schedule C)

Address of Business

(If other than personal residence)

Yes

No

Name of Business

Business Telephone Number

Employer Identification Number Business Website

Trade Name or dba

(

)

-

Average Gross Monthly

Description of Business

Total Number of Employees

Frequency of Tax Deposits

Payroll $

433-A (OIC)

Catalog Number 55896Q

Form

(Rev. 5-2012)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28