Schedule

WC

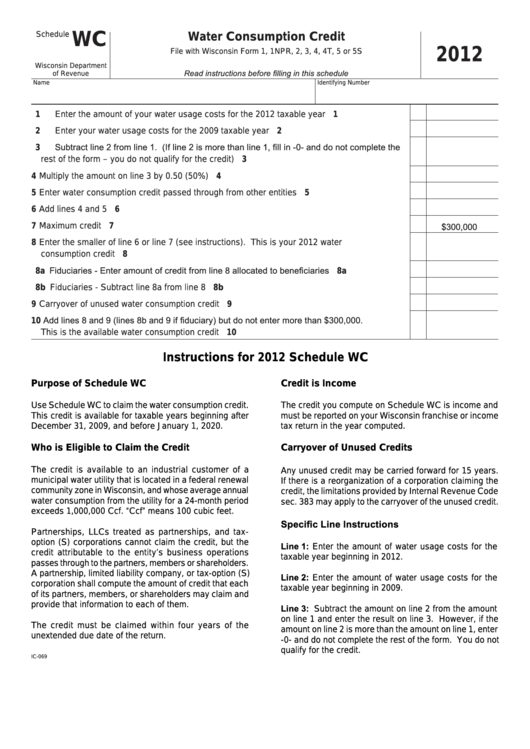

Water Consumption Credit

2012

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5 or 5S

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Identifying Number

1

Enter the amount of your water usage costs for the 2012 taxable year . . . . . . . . . . . . . . . . . 1

2

Enter your water usage costs for the 2009 taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Subtract line 2 from line 1. (If line 2 is more than line 1, fill in -0- and do not complete the

3

rest of the form – you do not qualify for the credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4

Multiply the amount on line 3 by 0 .50 (50%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5

Enter water consumption credit passed through from other entities . . . . . . . . . . . . . . . . . . . 5

6

Add lines 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

$300,000

7

Maximum credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8

Enter the smaller of line 6 or line 7 (see instructions) . This is your 2012 water

consumption credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

8a Fiduciaries - Enter amount of credit from line 8 allocated to beneficiaries . . . . . . . . . . . . . . . 8a

8b Fiduciaries - Subtract line 8a from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8b

9

Carryover of unused water consumption credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Add lines 8 and 9 (lines 8b and 9 if fiduciary) but do not enter more than $300,000.

10

This is the available water consumption credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Instructions for 2012 Schedule WC

Purpose of Schedule WC

Credit is Income

Use Schedule WC to claim the water consumption credit .

The credit you compute on Schedule WC is income and

This credit is available for taxable years beginning after

must be reported on your Wisconsin franchise or income

December 31, 2009, and before January 1, 2020 .

tax return in the year computed .

Who is Eligible to Claim the Credit

Carryover of Unused Credits

The credit is available to an industrial customer of a

Any unused credit may be carried forward for 15 years .

municipal water utility that is located in a federal renewal

If there is a reorganization of a corporation claiming the

community zone in Wisconsin, and whose average annual

credit, the limitations provided by Internal Revenue Code

water consumption from the utility for a 24-month period

sec . 383 may apply to the carryover of the unused credit .

exceeds 1,000,000 Ccf . “Ccf” means 100 cubic feet .

Specific Line Instructions

Partnerships, LLCs treated as partnerships, and tax-

option (S) corporations cannot claim the credit, but the

Line 1: Enter the amount of water usage costs for the

credit attributable to the entity’s business operations

taxable year beginning in 2012 .

passes through to the partners, members or shareholders .

A partnership, limited liability company, or tax-option (S)

Line 2: Enter the amount of water usage costs for the

corporation shall compute the amount of credit that each

taxable year beginning in 2009 .

of its partners, members, or shareholders may claim and

provide that information to each of them .

Line 3: Subtract the amount on line 2 from the amount

on line 1 and enter the result on line 3 . However, if the

The credit must be claimed within four years of the

amount on line 2 is more than the amount on line 1, enter

unextended due date of the return .

-0- and do not complete the rest of the form . You do not

qualify for the credit .

IC-069

1

1 2

2