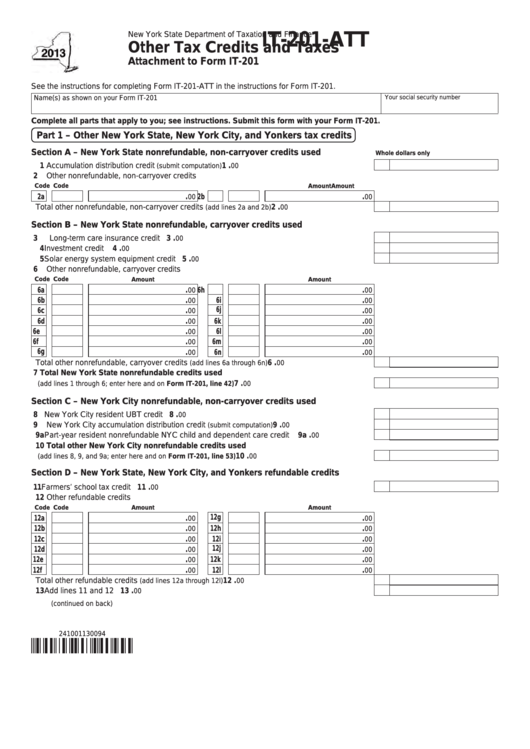

New York State Department of Taxation and Finance

IT-201-ATT

Other Tax Credits and Taxes

Attachment to Form IT-201

See the instructions for completing Form IT-201-ATT in the instructions for Form IT-201.

Your social security number

Name(s) as shown on your Form IT-201

Complete all parts that apply to you; see instructions. Submit this form with your Form IT-201.

Part 1 – Other New York State, New York City, and Yonkers tax credits

Section A – New York State nonrefundable, non-carryover credits used

Whole dollars only

.

1 Accumulation distribution credit

...................................................................

1

(submit computation)

00

2 Other nonrefundable, non-carryover credits

Code

Amount

Code

Amount

.

.

2a

2b

00

00

.

Total other nonrefundable, non-carryover credits

.......................................

2

(add lines 2a and 2b)

00

Section B – New York State nonrefundable, carryover credits used

.

3 Long-term care insurance credit ................................................................................................

3

00

.

4 Investment credit ........................................................................................................................

4

00

.

5 Solar energy system equipment credit .......................................................................................

5

00

6 Other nonrefundable, carryover credits

Code

Code

Amount

Amount

.

.

6a

6h

00

00

.

.

6b

6i

00

00

6j

.

.

6c

00

00

.

.

6d

6k

00

00

.

.

6e

6l

00

00

.

.

6f

6m

00

00

6g

.

.

6n

00

00

.

Total other nonrefundable, carryover credits

.........................................

6

(add lines 6a through 6n)

00

7 Total New York State nonrefundable credits used

.

......................................................

7

(add lines 1 through 6; enter here and on Form IT-201, line 42)

00

Section C – New York City nonrefundable, non-carryover credits used

.

8 New York City resident UBT credit .............................................................................................

8

00

.

9 New York City accumulation distribution credit

...........................................

9

(submit computation)

00

.

9a Part-year resident nonrefundable NYC child and dependent care credit .................................. 9a

00

10 Total other New York City nonrefundable credits used

.

..................................................... 10

(add lines 8, 9, and 9a; enter here and on Form IT-201, line 53)

00

Section D – New York State, New York City, and Yonkers refundable credits

.

11 Farmers’ school tax credit .......................................................................................................... 11

00

12 Other refundable credits

Code

Amount

Code

Amount

.

12g

.

12a

00

00

.

.

12b

12h

00

00

.

.

12c

12i

00

00

.

12j

.

12d

00

00

.

.

12e

12k

00

00

.

.

12f

12l

00

00

.

Total other refundable credits

.............................................................. 12

(add lines 12a through 12l)

00

.

13 Add lines 11 and 12 .................................................................................................................... 13

00

(continued on back)

241001130094

1

1 2

2