Instructions For Form It-1 - Inheritance Tax - 2011

ADVERTISEMENT

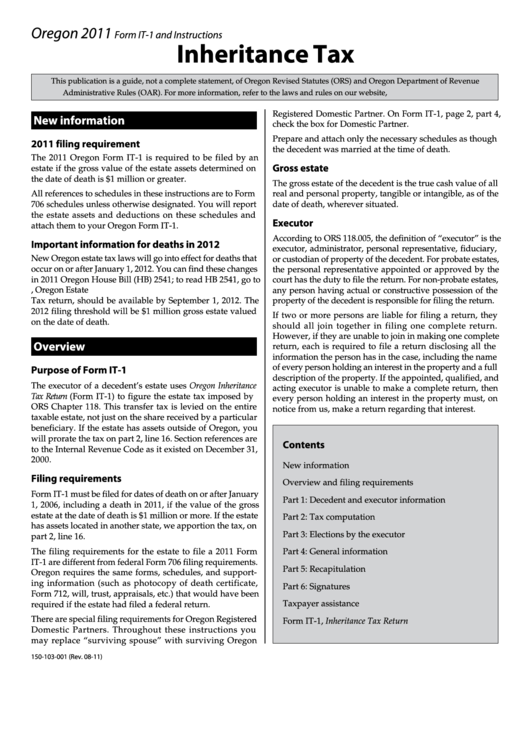

Oregon 2011

Form IT-1 and Instructions

Inheritance Tax

This publication is a guide, not a complete statement, of Oregon Revised Statutes (ORS) and Oregon Department of Revenue

Administrative Rules (OAR). For more information, refer to the laws and rules on our website,

Registered Domestic Partner. On Form IT-1, page 2, part 4,

New information

check the box for Domestic Partner.

Prepare and attach only the necessary schedules as though

2011 filing requirement

the decedent was married at the time of death.

The 2011 Oregon Form IT-1 is required to be filed by an

Gross estate

estate if the gross value of the estate assets determined on

the date of death is $1 million or greater.

The gross estate of the decedent is the true cash value of all

All references to schedules in these instructions are to Form

real and personal property, tangible or intangible, as of the

706 schedules unless otherwise designated. You will report

date of death, wherever situated.

the estate assets and deductions on these schedules and

Executor

attach them to your Oregon Form IT-1.

According to ORS 118.005, the definition of “executor” is the

Important information for deaths in 2012

executor, administrator, personal representative, fiduciary,

New Oregon estate tax laws will go into effect for deaths that

or custodian of property of the decedent. For probate estates,

occur on or after January 1, 2012. You can find these changes

the personal representative appointed or approved by the

in 2011 Oregon House Bill (HB) 2541; to read HB 2541, go to

court has the duty to file the return. For non-probate estates,

Form OR-706, Oregon Estate

any person having actual or constructive possession of the

Tax return, should be available by September 1, 2012. The

property of the decedent is responsible for filing the return.

2012 filing threshold will be $1 million gross estate valued

If two or more persons are liable for filing a return, they

on the date of death.

should all join together in filing one complete return.

However, if they are unable to join in making one complete

Overview

return, each is required to file a return disclosing all the

information the person has in the case, including the name

of every person holding an interest in the property and a full

Purpose of Form IT-1

description of the property. If the appointed, qualified, and

The executor of a decedent’s estate uses Oregon Inheritance

acting executor is unable to make a complete return, then

Tax Return (Form IT-1) to figure the estate tax imposed by

every person holding an interest in the property must, on

ORS Chapter 118. This transfer tax is levied on the entire

notice from us, make a return regarding that interest.

taxable estate, not just on the share received by a particular

beneficiary. If the estate has assets outside of Oregon, you

will prorate the tax on part 2, line 16. Section references are

Contents

to the Internal Revenue Code as it existed on December 31,

2000.

New information .............................................................1

Filing requirements

Overview and filing requirements ................................1

Form IT-1 must be filed for dates of death on or after January

Part 1: Decedent and executor information .................3

1, 2006, including a death in 2011, if the value of the gross

estate at the date of death is $1 million or more. If the estate

Part 2: Tax computation ..................................................3

has assets located in another state, we apportion the tax, on

Part 3: Elections by the executor ...................................9

part 2, line 16.

The filing requirements for the estate to file a 2011 Form

Part 4: General information .........................................14

IT-1 are different from federal Form 706 filing requirements.

Part 5: Recapitulation ....................................................15

Oregon requires the same forms, schedules, and support-

ing information (such as photocopy of death certificate,

Part 6: Signatures ...........................................................15

Form 712, will, trust, appraisals, etc.) that would have been

Taxpayer assistance .......................................................16

required if the estate had filed a federal return.

There are special filing requirements for Oregon Registered

Form IT-1, Inheritance Tax Return .................................17

Domestic Partners. Throughout these instructions you

may replace “surviving spouse” with surviving Oregon

150-103-001 (Rev. 08-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19