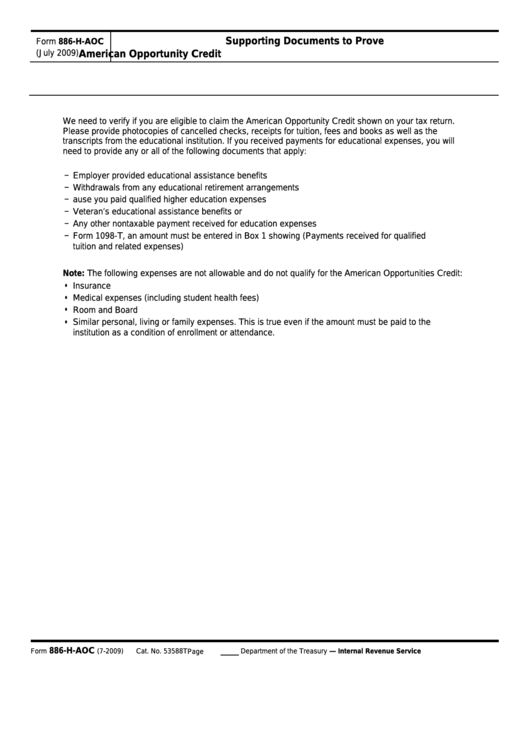

Form 886-H-Aoc - Supporting Documents To Prove American Opportunity Credit

ADVERTISEMENT

Supporting Documents to Prove

Form 886-H-AOC

(July 2009)

American Opportunity Credit

We need to verify if you are eligible to claim the American Opportunity Credit shown on your tax return.

Please provide photocopies of cancelled checks, receipts for tuition, fees and books as well as the

transcripts from the educational institution. If you received payments for educational expenses, you will

need to provide any or all of the following documents that apply:

–

Employer provided educational assistance benefits

–

Withdrawals from any educational retirement arrangements

–

U.S. Savings bond interest that is nontaxable because you paid qualified higher education expenses

–

Veteran’s educational assistance benefits or

–

Any other nontaxable payment received for education expenses

–

Form 1098-T, an amount must be entered in Box 1 showing (Payments received for qualified

tuition and related expenses)

Note: The following expenses are not allowable and do not qualify for the American Opportunities Credit:

•

Insurance

•

Medical expenses (including student health fees)

•

Room and Board

•

Similar personal, living or family expenses. This is true even if the amount must be paid to the

institution as a condition of enrollment or attendance.

886-H-AOC

Cat. No. 53588T

Form

(7-2009)

Page

publish.no.irs.gov

Department of the Treasury — Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1