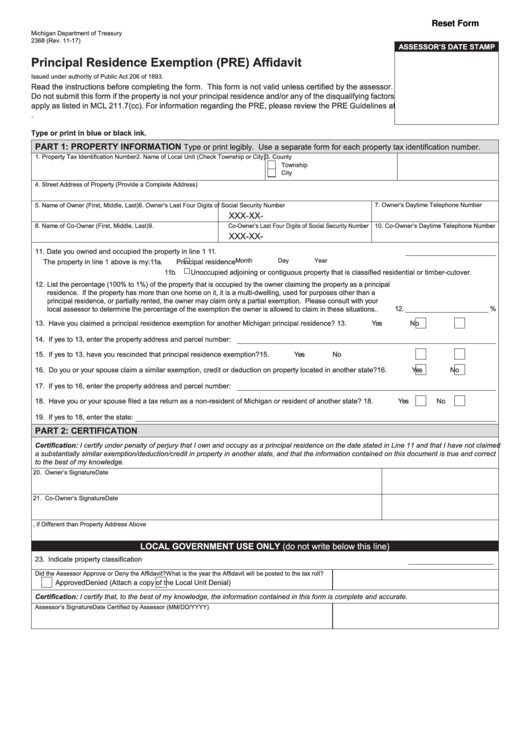

Principal Residence Exemption (Pre) Affidavit

ADVERTISEMENT

Reset Form

Michigan Department of Treasury

2368 (Rev. 11-17)

ASSESSOR’S DATE STAMP

Principal Residence Exemption (PRE) Affidavit

Issued under authority of Public Act 206 of 1893.

Read the instructions before completing the form. This form is not valid unless certified by the assessor.

Do not submit this form if the property is not your principal residence and/or any of the disqualifying factors

apply as listed in MCL 211.7(cc). For information regarding the PRE, please review the PRE Guidelines at

Type or print in blue or black ink.

PART 1: PROPERTY INFORMATION

Type or print legibly. Use a separate form for each property tax identification number.

1. Property Tax Identification Number

2. Name of Local Unit (Check Township or City) 3. County

Township

City

4. Street Address of Property (Provide a Complete Address)

5. Name of Owner (First, Middle, Last)

6. Owner’s Last Four Digits of Social Security Number

7. Owner’s Daytime Telephone Number

XXX-XX-

8. Name of Co-Owner (First, Middle, Last)

9. Co-Owner’s Last Four Digits of Social Security Number

10. Co-Owner’s Daytime Telephone Number

XXX-XX-

11. Date you owned and occupied the property in line 1 ............................................................................................... 11.

Month

Day

Year

The property in line 1 above is my:

11a.

Principal residence

11b.

Unoccupied adjoining or contiguous property that is classified residential or timber-cutover.

12. List the percentage (100% to 1%) of the property that is occupied by the owner claiming the property as a principal

residence. If the property has more than one home on it, it is a multi-dwelling, used for purposes other than a

principal residence, or partially rented, the owner may claim only a partial exemption. Please consult with your

local assessor to determine the percentage of the exemption the owner is allowed to claim in these situations.. ...... 12.

%

13. Have you claimed a principal residence exemption for another Michigan principal residence? ............................... 13.

Yes

No

14. If yes to 13, enter the property address and parcel number:

15. If yes to 13, have you rescinded that principal residence exemption? ...................................................................... 15.

Yes

No

16. Do you or your spouse claim a similar exemption, credit or deduction on property located in another state? .......... 16.

Yes

No

17. If yes to 16, enter the property address and parcel number:

18. Have you or your spouse filed a tax return as a non-resident of Michigan or resident of another state? ................ 18.

Yes

No

19. If yes to 18, enter the state:

PART 2: CERTIFICATION

Certification: I certify under penalty of perjury that I own and occupy as a principal residence on the date stated in Line 11 and that I have not claimed

a substantially similar exemption/deduction/credit in property in another state, and that the information contained on this document is true and correct

to the best of my knowledge.

20. Owner’s Signature

Date

21. Co-Owner’s Signature

Date

22. Mailing Address, if Different than Property Address Above

LOCAL GOVERNMENT USE ONLY (do not write below this line)

23. Indicate property classification ................................................................................................................................ 23.

Did the Assessor Approve or Deny the Affidavit?

What is the year the Affidavit will be posted to the tax roll?

Approved

Denied (Attach a copy of the Local Unit Denial)

Certification: I certify that, to the best of my knowledge, the information contained in this form is complete and accurate.

Assessor’s Signature

Date Certified by Assessor (MM/DD/YYYY)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2