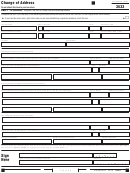

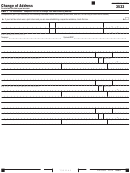

California Form 3533 - Change Of Address Page 3

ADVERTISEMENT

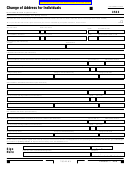

2014 Instructions for Form FTB 3533

Change of Address

General Information

Additional Information

For purposes of California income tax, references to a spouse,

If you complete Part I, use the Additional Information field for

husband, or wife also refer to a California registered domestic partner

“In‑Care‑Of” name or other supplemental address information only .

(RDP), unless otherwise specified . When we use the initials RDP they

If you complete Part II, use the Additional Information field for owner,

refer to both a California registered domestic “partner” and a California

representative, or attention name or supplemental address information

registered domestic “partnership,” as applicable . For more information

only .

on RDPs, get FTB Pub . 737, Tax Information for Registered Domestic

PO Box

Partners .

Purpose

If your post office does not deliver mail to your street address, show

your PO box number instead of your street address .

Use form FTB 3533, Change of Address, to change your home or

Foreign Address

business mailing address or your business location . This address

change will be used for future correspondence . Generally, complete

If you have a foreign address enter the city, foreign country name,

only one form FTB 3533 to change your home or business address . If

foreign province/state/county name, and foreign postal code in the

this change also affects the mailing address for your children who filed

appropriate boxes . Do not abbreviate the foreign country name . Follow

separate tax returns, complete a separate form FTB 3533 for each child .

the country’s practice for entering the province/state/county name and

If you are a representative filing for the taxpayer, attach a copy of your

foreign postal code .

form FTB 3520, Power of Attorney, to this form and write “copy” at the

top of form FTB 3520 .

Part III Signature

You may also go to ftb.ca.gov and search for myftb account (individuals

If you complete Part I, you must sign in the space provided . If you filed

only) or call 800 .852 .5711 to change your address . If you change your

a joint tax return, your spouse/RDP must also sign .

address online or by phone, you do not need to file this form .

If you complete Part II, the owner, officer, or a representative must

Part I

Home Mailing Address

sign and enter their title . An officer is the president, vice president,

treasurer, chief accounting officer, etc . A representative is a person

Complete Part I only if you file any of the following individual income tax

who maintains a valid power of attorney to handle tax matters .

returns: Forms 540, 540 2EZ, or the Long or Short Form 540NR .

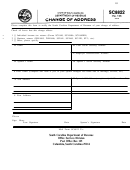

Where to File

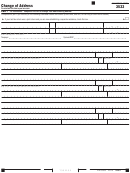

Part II Business Mailing Address or Business

Mail this form to:

Location Address

FRANCHISE TAX BOARD

Complete Part II only if you file any of the following business, estate or

PO BOX 942840

trust income tax returns: Forms 100, 100S, 100W, 109, 199, 541, 565,

SACRAMENTO CA 94240-0002

or 568 .

If you moved after you filed your tax return and you are expecting

a refund, notify the post office serving your old address to assist in

Name and Address

forwarding your check to the new address .

If you complete Part I, enter your first name, middle initial, last name,

social security number (SSN) or individual taxpayer identification

number (ITIN), and address in the spaces provided . If a joint tax

return, enter the name and SSN of your spouse/RDP .

If you complete Part II, enter the business, estate, or trust name and

address . Enter a California corporation number or California Secretary

of State file number and federal employer identification number (FEIN) .

Prior Name(s)

If you or your spouse/RDP changed your name because of marriage,

divorce, etc ., enter the prior last name only in the “Prior name(s)” field

in Part I .

FTB 3533 Instructions 2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3