Form Wv/bcs-A - Application For West Virginia Business Investment And Jobs Expansion Tax Credit For Investments Placed In Service On Or After January 1, 1990

ADVERTISEMENT

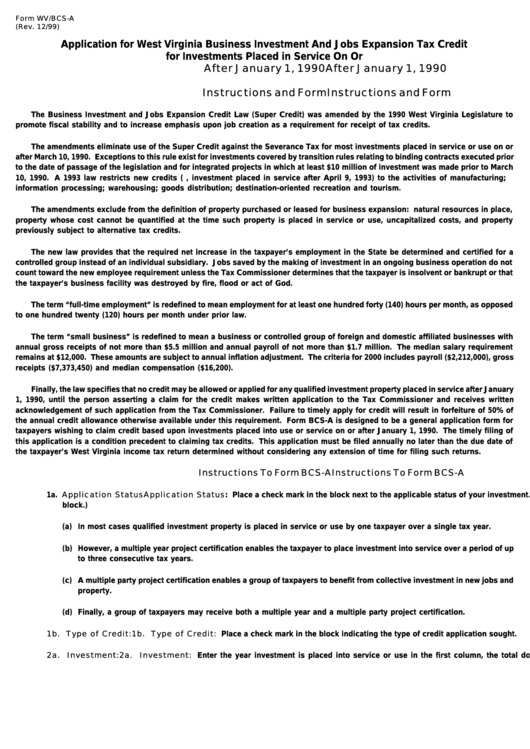

Form WV/BCS-A

(Rev. 12/99)

Application for West Virginia Business Investment And Jobs Expansion Tax Credit

for Investments Placed in Service On Or

After January 1, 1990

After January 1, 1990

Instructions and Form

Instructions and Form

The Business Investment and Jobs Expansion Credit Law (Super Credit) was amended by the 1990 West Virginia Legislature to

promote fiscal stability and to increase emphasis upon job creation as a requirement for receipt of tax credits.

The amendments eliminate use of the Super Credit against the Severance Tax for most investments placed in service or use on or

after March 10, 1990. Exceptions to this rule exist for investments covered by transition rules relating to binding contracts executed prior

to the date of passage of the legislation and for integrated projects in which at least $10 million of investment was made prior to March

10, 1990. A 1993 law restricts new credits (i.e., investment placed in service after April 9, 1993) to the activities of manufacturing;

information processing; warehousing; goods distribution; destination-oriented recreation and tourism.

The amendments exclude from the definition of property purchased or leased for business expansion: natural resources in place,

property whose cost cannot be quantified at the time such property is placed in service or use, uncapitalized costs, and property

previously subject to alternative tax credits.

The new law provides that the required net increase in the taxpayer’s employment in the State be determined and certified for a

controlled group instead of an individual subsidiary. Jobs saved by the making of investment in an ongoing business operation do not

count toward the new employee requirement unless the Tax Commissioner determines that the taxpayer is insolvent or bankrupt or that

the taxpayer’s business facility was destroyed by fire, flood or act of God.

The term “full-time employment” is redefined to mean employment for at least one hundred forty (140) hours per month, as opposed

to one hundred twenty (120) hours per month under prior law.

The term “small business” is redefined to mean a business or controlled group of foreign and domestic affiliated businesses with

annual gross receipts of not more than $5.5 million and annual payroll of not more than $1.7 million. The median salary requirement

remains at $12,000. These amounts are subject to annual inflation adjustment. The criteria for 2000 includes payroll ($2,212,000), gross

receipts ($7,373,450) and median compensation ($16,200).

Finally, the law specifies that no credit may be allowed or applied for any qualified investment property placed in service after January

1, 1990, until the person asserting a claim for the credit makes written application to the Tax Commissioner and receives written

acknowledgement of such application from the Tax Commissioner. Failure to timely apply for credit will result in forfeiture of 50% of

the annual credit allowance otherwise available under this requirement. Form BCS-A is designed to be a general application form for

taxpayers wishing to claim credit based upon investments placed into use or service on or after January 1, 1990. The timely filing of

this application is a condition precedent to claiming tax credits. This application must be filed annually no later than the due date of

the taxpayer’s West Virginia income tax return determined without considering any extension of time for filing such returns.

Instructions To Form BCS-A

Instructions To Form BCS-A

1a. Application Status

Application Status: Place a check mark in the block next to the applicable status of your investment. (Check only one

block.)

(a) In most cases qualified investment property is placed in service or use by one taxpayer over a single tax year.

(b) However, a multiple year project certification enables the taxpayer to place investment into service over a period of up

to three consecutive tax years.

(c) A multiple party project certification enables a group of taxpayers to benefit from collective investment in new jobs and

property.

(d) Finally, a group of taxpayers may receive both a multiple year and a multiple party project certification.

1b. Type of Credit:

1b. Type of Credit: Place a check mark in the block indicating the type of credit application sought.

2a.

2a.

Investment:

Investment: Enter the year investment is placed into service or use in the first column, the total dollar amount of

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4