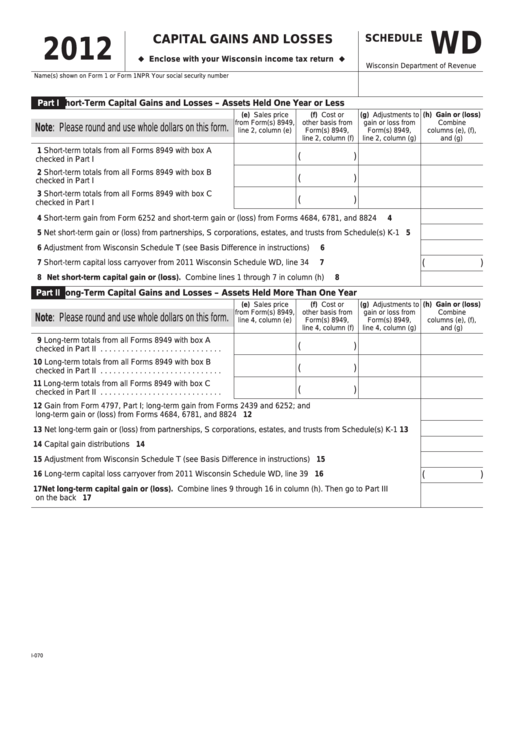

WD

CAPITAL GAINS AND LOSSES

SCHEDULE

2012

u

u

Enclose with your Wisconsin income tax return

Wisconsin Department of Revenue

Name(s) shown on Form 1 or Form 1NPR

Your social security number

Part I

Short-Term Capital Gains and Losses – Assets Held One Year or Less

(e) Sales price

(f) Cost or

(g) Adjustments to

(h) Gain or (loss)

from Form(s) 8949,

other basis from

gain or loss from

Combine

Note: Please round and use whole dollars on this form.

line 2, column (e)

Form(s) 8949,

Form(s) 8949,

columns (e), (f),

line 2, column (f)

line 2, column (g)

and (g)

1 Short-term totals from all Forms 8949 with box A

(

)

checked in Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Short-term totals from all Forms 8949 with box B

(

)

checked in Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Short-term totals from all Forms 8949 with box C

(

)

checked in Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 . . . . .

4

5 Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1

5

6 Adjustment from Wisconsin Schedule T (see Basis Difference in instructions) . . . . . . . . . . . . . . . . . . . . .

6

(

)

7 Short-term capital loss carryover from 2011 Wisconsin Schedule WD, line 34 . . . . . . . . . . . . . . . . . . . . .

7

8 Net short-term capital gain or (loss). Combine lines 1 through 7 in column (h) . . . . . . . . . . . . . . . . . .

8

Part II

Long-Term Capital Gains and Losses – Assets Held More Than One Year

(e) Sales price

(f) Cost or

(g) Adjustments to

(h) Gain or (loss)

from Form(s) 8949,

other basis from

gain or loss from

Combine

Note: Please round and use whole dollars on this form.

line 4, column (e)

Form(s) 8949,

Form(s) 8949,

columns (e), (f),

line 4, column (f)

line 4, column (g)

and (g)

9 Long-term totals from all Forms 8949 with box A

(

)

checked in Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Long-term totals from all Forms 8949 with box B

(

)

checked in Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Long-term totals from all Forms 8949 with box C

(

)

checked in Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Gain from Form 4797, Part I; long-term gain from Forms 2439 and 6252; and

long-term gain or (loss) from Forms 4684, 6781, and 8824 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1

13

14 Capital gain distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Adjustment from Wisconsin Schedule T (see Basis Difference in instructions) . . . . . . . . . . . . . . . . . . . . . 15

(

)

16 Long-term capital loss carryover from 2011 Wisconsin Schedule WD, line 39 . . . . . . . . . . . . . . . . . . . . . 16

17 Net long-term capital gain or (loss). Combine lines 9 through 16 in column (h). Then go to Part III

on the back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

I-070

1

1 2

2