Form Cnf-120opt - Election To Report Based On Worldwide Unitary Combined Basis - 2011

ADVERTISEMENT

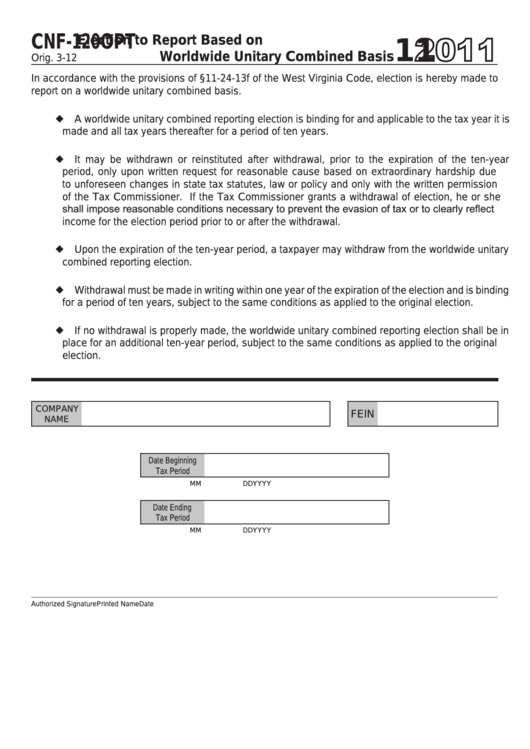

CNF-120OPT

11

Election to Report Based on

Worldwide Unitary Combined Basis

Orig. 3-12

In accordance with the provisions of §11-24-13f of the West Virginia Code, election is hereby made to

report on a worldwide unitary combined basis.

¡ A worldwide unitary combined reporting election is binding for and applicable to the tax year it is

made and all tax years thereafter for a period of ten years.

¡ It may be withdrawn or reinstituted after withdrawal, prior to the expiration of the ten-year

period, only upon written request for reasonable cause based on extraordinary hardship due

to unforeseen changes in state tax statutes, law or policy and only with the written permission

of the Tax Commissioner. If the Tax Commissioner grants a withdrawal of election, he or she

shall impose reasonable conditions necessary to prevent the evasion of tax or to clearly reflect

income for the election period prior to or after the withdrawal.

¡ Upon the expiration of the ten-year period, a taxpayer may withdraw from the worldwide unitary

combined reporting election.

¡ Withdrawal must be made in writing within one year of the expiration of the election and is binding

for a period of ten years, subject to the same conditions as applied to the original election.

¡ If no withdrawal is properly made, the worldwide unitary combined reporting election shall be in

place for an additional ten-year period, subject to the same conditions as applied to the original

election.

COMPANY

FEIN

NAME

Date Beginning

Tax Period

MM

DD

YYYY

Date Ending

Tax Period

MM

DD

YYYY

Authorized Signature

Printed Name

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1