Form Rev 86 0059e - Leasehold Excise Tax Return Federal Permit Or Lease - Washington State Department Of Revenue - 2012

ADVERTISEMENT

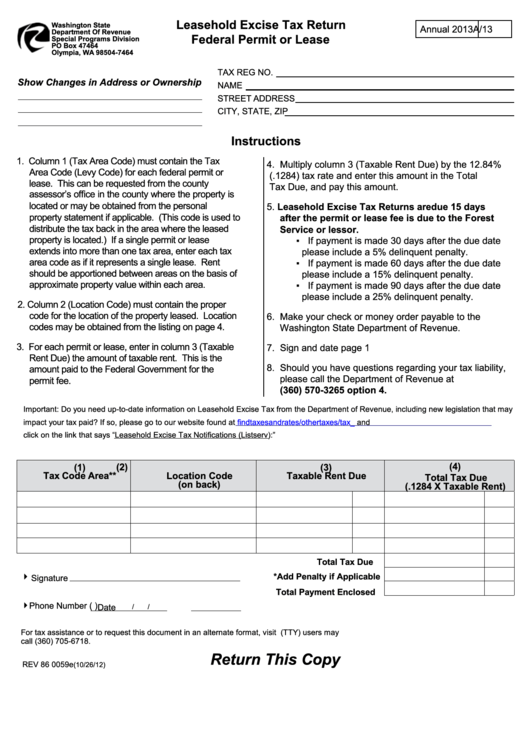

Leasehold Excise Tax Return

Washington State

Annual 2013

A/13

Department Of Revenue

Federal Permit or Lease

Special Programs Division

PO Box 47464

Olympia, WA 98504-7464

TAX REG NO.

Show Changes in Address or Ownership

NAME

STREET ADDRESS

CITY, STATE, ZIP

Instructions

1. Column 1 (Tax Area Code) must contain the Tax

4. Multiply column 3 (Taxable Rent Due) by the 12.84%

Area Code (Levy Code) for each federal permit or

(.1284) tax rate and enter this amount in the Total

lease. This can be requested from the county

Tax Due, and pay this amount.

assessor’s office in the county where the property is

located or may be obtained from the personal

5. Leasehold Excise Tax Returns are due 15 days

property statement if applicable. (This code is used to

after the permit or lease fee is due to the Forest

distribute the tax back in the area where the leased

Service or lessor.

property is located.) If a single permit or lease

▪ If payment is made 30 days after the due date

extends into more than one tax area, enter each tax

please include a 5% delinquent penalty.

area code as if it represents a single lease. Rent

▪ If payment is made 60 days after the due date

should be apportioned between areas on the basis of

please include a 15% delinquent penalty.

approximate property value within each area.

▪ If payment is made 90 days after the due date

please include a 25% delinquent penalty.

2. Column 2 (Location Code) must contain the proper

code for the location of the property leased. Location

6. Make your check or money order payable to the

codes may be obtained from the listing on page 4.

Washington State Department of Revenue.

3. For each permit or lease, enter in column 3 (Taxable

7. Sign and date page 1

Rent Due) the amount of taxable rent. This is the

8. Should you have questions regarding your tax liability,

amount paid to the Federal Government for the

please call the Department of Revenue at

permit fee.

(360) 570-3265 option 4.

Important: Do you need up-to-date information on Leasehold Excise Tax from the Department of Revenue, including new legislation that may

impact your tax paid? If so, please go to our website found at

and

click on the link that says “Leasehold Excise Tax Notifications (Listserv):”

(4)

(1)

(2)

(3)

Tax Code Area**

Location Code

Taxable Rent Due

Total Tax Due

(on back)

(.1284 X Taxable Rent)

Total Tax Due

*Add Penalty if Applicable

4

Signature

Total Payment Enclosed

Phone Number (

)

4

Date

/

/

For tax assistance or to request this document in an alternate format, visit or call 1-800-647-7706. Teletype (TTY) users may

call (360) 705-6718.

Return This Copy

REV 86 0059e

(10/26/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4