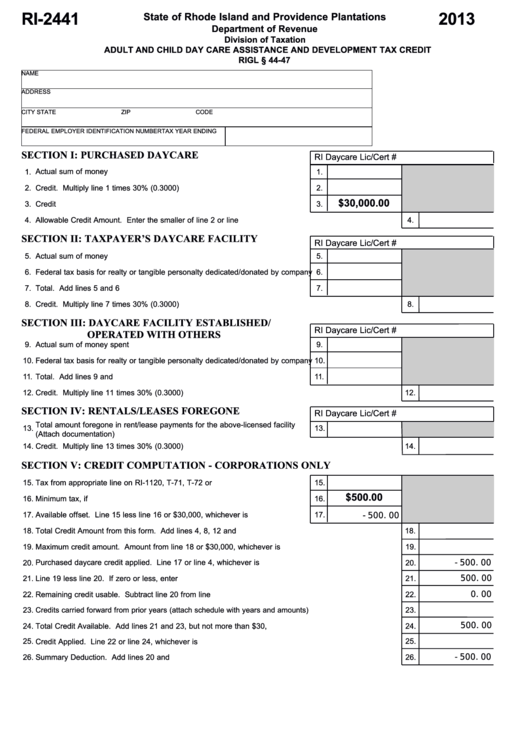

RI-2441

2013

State of Rhode Island and Providence Plantations

Department of Revenue

Division of Taxation

ADULT AND CHILD DAY CARE ASSISTANCE AND DEVELOPMENT TAX CREDIT

RIGL § 44-47

NAME

ADDRESS

CITY

STATE

ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER

TAX YEAR ENDING

SECTION I: PURCHASED DAYCARE

RI Daycare Lic/Cert #

1.

Actual sum of money spent.....................................................................................

1.

2.

Credit. Multiply line 1 times 30% (0.3000)..............................................................

2.

$30,000.00

3.

Credit Limit...............................................................................................................

3.

4.

Allowable Credit Amount. Enter the smaller of line 2 or line 3..........................................................................

4.

SECTION II: TAXPAYER’S DAYCARE FACILITY

RI Daycare Lic/Cert #

5.

Actual sum of money spent.....................................................................................

5.

6.

Federal tax basis for realty or tangible personalty dedicated/donated by company

6.

7.

Total. Add lines 5 and 6 .........................................................................................

7.

8.

Credit. Multiply line 7 times 30% (0.3000) .......................................................................................................

8.

SECTION III: DAYCARE FACILITY ESTABLISHED/

RI Daycare Lic/Cert #

OPERATED WITH OTHERS

9.

Actual sum of money spent ....................................................................................

9.

10.

Federal tax basis for realty or tangible personalty dedicated/donated by company

10.

11.

Total. Add lines 9 and 10........................................................................................

11.

12.

Credit. Multiply line 11 times 30% (0.3000) ......................................................................................................

12.

SECTION IV: RENTALS/LEASES FOREGONE

RI Daycare Lic/Cert #

Total amount foregone in rent/lease payments for the above-licensed facility

13.

13.

(Attach documentation)............................................................................................

14.

Credit. Multiply line 13 times 30% (0.3000)......................................................................................................

14.

SECTION V: CREDIT COMPUTATION - CORPORATIONS ONLY

15.

Tax from appropriate line on RI-1120, T-71, T-72 or T-74.......................................

15.

$500.00

16.

Minimum tax, if applicable.......................................................................................

16.

-500.00

17.

Available offset. Line 15 less line 16 or $30,000, whichever is less......................

17.

18.

Total Credit Amount from this form. Add lines 4, 8, 12 and 14.........................................................................

18.

19.

Maximum credit amount. Amount from line 18 or $30,000, whichever is less..................................................

19.

-500.00

Purchased daycare credit applied. Line 17 or line 4, whichever is less............................................................

20.

20.

500.00

21.

Line 19 less line 20. If zero or less, enter zero..................................................................................................

21.

0.00

Remaining credit usable. Subtract line 20 from line 17.....................................................................................

22.

22.

23.

Credits carried forward from prior years (attach schedule with years and amounts).............................................

23.

500.00

24.

Total Credit Available. Add lines 21 and 23, but not more than $30,000.00......................................................

24.

25.

25.

Credit Applied. Line 22 or line 24, whichever is less.........................................................................................

-500.00

26.

Summary Deduction. Add lines 20 and 25........................................................................................................

26.

1

1 2

2