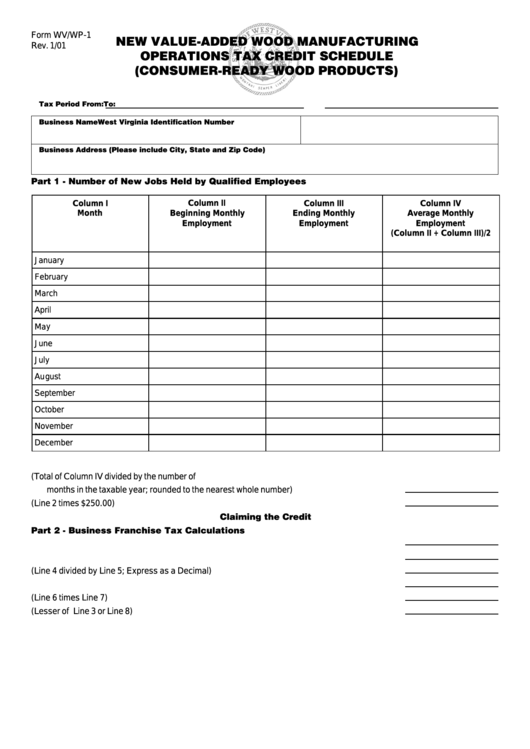

Form Wv/wp-1 - New Value-Added Wood Manufacturing Operations Tax Credit Schedule (Consumer-Ready Wood Products)

ADVERTISEMENT

Form WV/WP-1

Rev. 1/01

Column I

Column II

Column III

Column IV

Month

Beginning Monthly

Ending Monthly

Average Monthly

Employment

Employment

Employment

(Column II + Column III)/2

January

February

March

April

May

June

July

August

September

October

November

December

2. Number of New Jobs for Taxable Year (Total of Column IV divided by the number of

months in the taxable year; rounded to the nearest whole number) ............................................

3. Maximum Available Credit For Taxable Year (Line 2 times $250.00) ...........................................

4. Total WV Gross Income Attributable to New Consumer-Ready Wood Products .........................

5. Total WV Gross Income ............................................................................................................

6. Eligible Income Ratio (Line 4 divided by Line 5; Express as a Decimal) .....................................

7. Total Business Franchise Tax Liability after all other tax credits ................................................

8. Total Eligible Business Franchise Tax Liability (Line 6 times Line 7) ..........................................

9. Total Consumer-Ready Wood Products Credit (Lesser of Line 3 or Line 8) ................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4