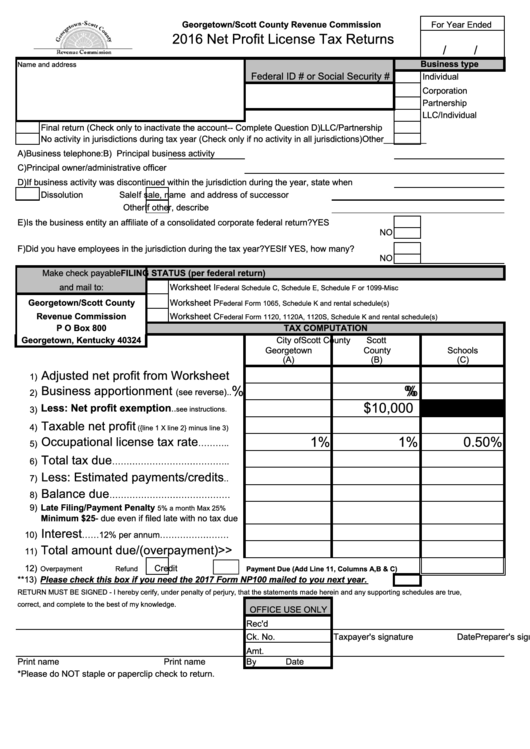

Form Net Profit License Tax Returns -2016

ADVERTISEMENT

Georgetown/Scott County Revenue Commission

For Year Ended

2016 Net Profit License Tax Returns

/

/

Business type

Name and address

Federal ID # or Social Security #

Individual

Corporation

Partnership

LLC/Individual

Final return (Check only to inactivate the account-- Complete Question D)

LLC/Partnership

No activity in jurisdictions during tax year (Check only if no activity in all jurisdictions)

Other_________

A)

Business telephone:

B) Principal business activity

C)

Principal owner/administrative officer

D)

If business activity was discontinued within the jurisdiction during the year, state when

Dissolution

Sale

If sale, name and address of successor

Other

If other, describe

E)

Is the business entity an affiliate of a consolidated corporate federal return?

YES

NO

F)

Did you have employees in the jurisdiction during the tax year?

YES

If YES, how many?

NO

Make check payable

FILING STATUS (per federal return)

and mail to:

Worksheet I

Federal Schedule C, Schedule E, Schedule F or 1099-Misc

Georgetown/Scott County

Worksheet P

Federal Form 1065, Schedule K and rental schedule(s)

Revenue Commission

Worksheet C

Federal Form 1120, 1120A, 1120S, Schedule K and rental schedule(s)

P O Box 800

TAX COMPUTATION

Georgetown, Kentucky 40324

City of

Scott

Scott County

Georgetown

County

Schools

(A)

(B)

(C)

Adjusted net profit from Worksheet

1)

%

%

%

Business apportionment

(see reverse)..

2)

$10,000

Less: Net profit exemption

..

3)

see instructions.

Taxable net profit

4)

({line 1 X line 2} minus line 3)

1%

1%

0.50%

Occupational license tax rate

………..

5)

Total tax due

6)

…………………………………..

Less: Estimated payments/credits

7)

..

Balance due

8)

……………………………………

9) Late Filing/Payment Penalty

5% a month Max 25%

Minimum $25- due even if filed late with no tax due

Interest

10)

……12% per annum……………………

Total amount due/(overpayment)>>

11)

12)

Credit

Overpayment

Refund

Payment Due (Add Line 11, Columns A,B & C)

**13) Please check this box if you need the 2017 Form NP100 mailed to you next year.

RETURN MUST BE SIGNED - I hereby cerify, under penalty of perjury, that the statements made herein and any supporting schedules are true,

correct, and complete to the best of my knowledge.

OFFICE USE ONLY

Rec'd

Preparer's signature

Date

Ck. No.

Taxpayer's signature

Date

Amt.

Print name

By

Print name

Date

*Please do NOT staple or paperclip check to return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5