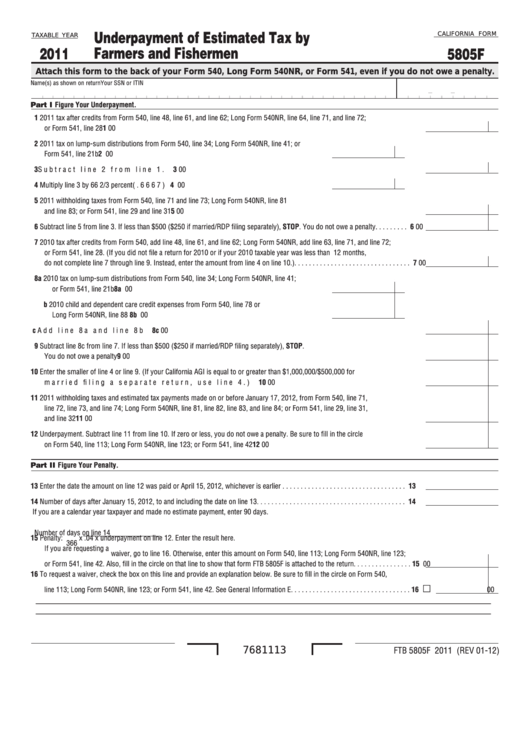

Underpayment of Estimated Tax by

CALIFORNIA FORM

TAXABLE YEAR

Farmers and Fishermen

2011

5805F

Attach this form to the back of your Form 540, Long Form 540NR, or Form 541, even if you do not owe a penalty.

Name(s) as shown on return

Your SSN or ITIN

–

–

Part I

Figure Your Underpayment.

1 2011 tax after credits from Form 540, line 48, line 61, and line 62; Long Form 540NR, line 64, line 71, and line 72;

or Form 541, line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 2011 tax on lump-sum distributions from Form 540, line 34; Long Form 540NR, line 41; or

Form 541, line 21b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Multiply line 3 by 66 2/3 percent ( .6667) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

00

5 2011 withholding taxes from Form 540, line 71 and line 73; Long Form 540NR, line 81

and line 83; or Form 541, line 29 and line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Subtract line 5 from line 3 . If less than $500 ($250 if married/RDP filing separately), STOP . You do not owe a penalty . . . . . . . . . 6

00

7 2010 tax after credits from Form 540, add line 48, line 61, and line 62; Long Form 540NR, add line 63, line 71, and line 72;

or Form 541, line 28 . (If you did not file a return for 2010 or if your 2010 taxable year was less than 12 months,

do not complete line 7 through line 9 . Instead, enter the amount from line 4 on line 10 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

00

8 a 2010 tax on lump-sum distributions from Form 540, line 34; Long Form 540NR, line 41;

or Form 541, line 21b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8a

00

b 2010 child and dependent care credit expenses from Form 540, line 78 or

Long Form 540NR, line 88 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8b

00

c Add line 8a and line 8b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c

00

9 Subtract line 8c from line 7 . If less than $500 ($250 if married/RDP filing separately), STOP .

You do not owe a penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

00

10 Enter the smaller of line 4 or line 9 . (If your California AGI is equal to or greater than $1,000,000/$500,000 for

married filing a separate return, use line 4 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11 2011 withholding taxes and estimated tax payments made on or before January 17, 2012, from Form 540, line 71,

line 72, line 73, and line 74; Long Form 540NR, line 81, line 82, line 83, and line 84; or Form 541, line 29, line 31,

and line 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

12 Underpayment . Subtract line 11 from line 10 . If zero or less, you do not owe a penalty . Be sure to fill in the circle

on Form 540, line 113; Long Form 540NR, line 123; or Form 541, line 42 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

00

Part II Figure Your Penalty.

13 Enter the date the amount on line 12 was paid or April 15, 2012, whichever is earlier . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Number of days after January 15, 2012, to and including the date on line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

If you are a calendar year taxpayer and made no estimate payment, enter 90 days .

Number of days on line 14

15 Penalty:

x .04 x underpayment on line 12 . Enter the result here .

366

If you are requesting a waiver, go to line 16 . Otherwise, enter this amount on Form 540, line 113; Long Form 540NR, line 123;

or Form 541, line 42 . Also, fill in the circle on that line to show that form FTB 5805F is attached to the return . . . . . . . . . . . . . . . . 15

00

16 To request a waiver, check the box on this line and provide an explanation below . Be sure to fill in the circle on Form 540,

line 113; Long Form 540NR, line 123; or Form 541, line 42 . See General Information E . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

_______________________________________________________________________________________

_______________________________________________________________________________________

FTB 5805F 2011 (REV 01-12)

7681113

1

1 2

2