Form Wv/hgbitc-1 - Schedule Wv/hgbitc-1 High-Growth Business Investment Tax Credit

ADVERTISEMENT

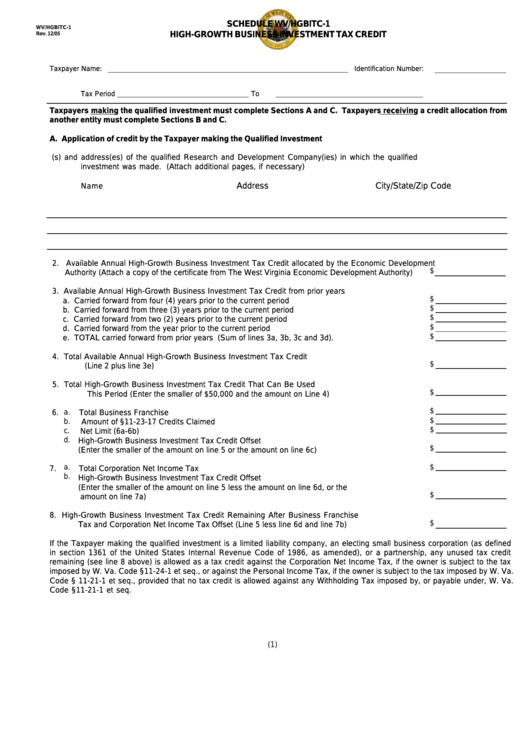

SCHEDULE WV/HGBITC-1

WV/HGBITC-1

Rev. 12/05

HIGH-GROWTH BUSINESS INVESTMENT TAX CREDIT

Taxpayer Name:

Identification Number:

Tax Period

To

Taxpayers making the qualified investment must complete Sections A and C. Taxpayers receiving a credit allocation from

another entity must complete Sections B and C.

A. Application of credit by the Taxpayer making the Qualified Investment

1.

Name(s) and address(es) of the qualified Research and Development Company(ies) in which the qualified

investment was made. (Attach additional pages, if necessary)

Address

City/State/Zip Code

Name

2. Available Annual High-Growth Business Investment Tax Credit allocated by the Economic Development

$

Authority (Attach a copy of the certificate from The West Virginia Economic Development Authority) .........

3. Available Annual High-Growth Business Investment Tax Credit from prior years

$

a. Carried forward from four (4) years prior to the current period ................................................................

$

b. Carried forward from three (3) years prior to the current period ..............................................................

$

c. Carried forward from two (2) years prior to the current period .................................................................

$

d. Carried forward from the year prior to the current period .........................................................................

$

e. TOTAL carried forward from prior years (Sum of lines 3a, 3b, 3c and 3d) ..............................................

4. Total Available Annual High-Growth Business Investment Tax Credit

$

(Line 2 plus line 3e) ...............................................................................................................................

5. Total High-Growth Business Investment Tax Credit That Can Be Used

$

This Period (Enter the smaller of $50,000 and the amount on Line 4) ...............................................

$

a.

6.

Total Business Franchise Tax ..................................................................................................................

$

b.

Amount of §11-23-17 Credits Claimed ...................................................................................................

$

c.

Net Limit (6a-6b) ......................................................................................................................................

d.

High-Growth Business Investment Tax Credit Offset

$

(Enter the smaller of the amount on line 5 or the amount on line 6c) ...................................................

a.

$

7.

Total Corporation Net Income Tax ............................................................................................................

b.

High-Growth Business Investment Tax Credit Offset

(Enter the smaller of the amount on line 5 less the amount on line 6d, or the

$

amount on line 7a) ...................................................................................................................................

8. High-Growth Business Investment Tax Credit Remaining After Business Franchise

$

Tax and Corporation Net Income Tax Offset (Line 5 less line 6d and line 7b) .......................................

If the Taxpayer making the qualified investment is a limited liability company, an electing small business corporation (as defined

in section 1361 of the United States Internal Revenue Code of 1986, as amended), or a partnership, any unused tax credit

remaining (see line 8 above) is allowed as a tax credit against the Corporation Net Income Tax, if the owner is subject to the tax

imposed by W. Va. Code §11-24-1 et seq., or against the Personal Income Tax, if the owner is subject to the tax imposed by W. Va.

Code § 11-21-1 et seq., provided that no tax credit is allowed against any Withholding Tax imposed by, or payable under, W. Va.

Code §11-21-1 et seq.

(1)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3