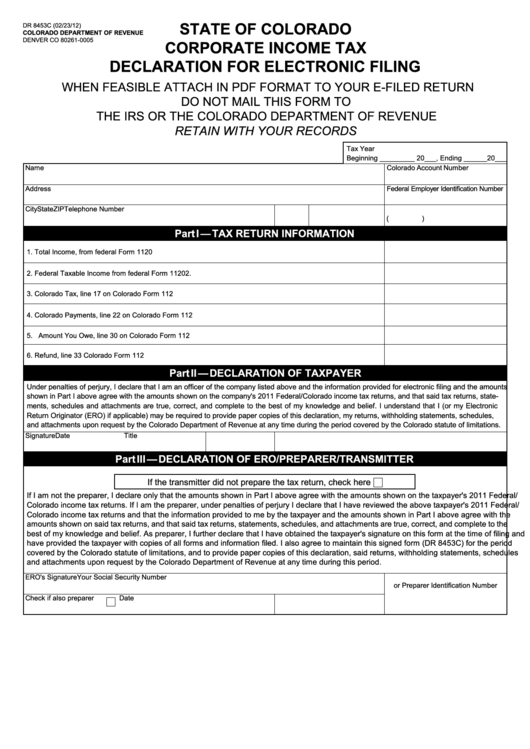

Form Dr 8453c - Corporate Income Tax Declaration For Electronic Filing

ADVERTISEMENT

state of Colorado

DR 8453C (02/23/12)

Colorado dePartment of revenue

DENVER CO 80261-0005

CorPorate inCome tax

deClaration for eleCtroniC filing

WHEN FEASIBLE ATTACH IN PDF FORMAT TO YOUR E-FILED RETURN

DO NOT MAIL THIS FORM TO

THE IRS OR THE COLORADO DEPARTMENT OF REVENUE

retain with your records

Tax Year

Beginning _________ 20___, Ending ______20___

Name

Colorado Account Number

Address

Federal Employer Identification Number

City

State

ZIP

Telephone Number

(

)

Part i — tax return information

1. Total Income, from federal Form 1120 ..................................................................................................................1.

2. Federal Taxable Income from federal Form 1120

2.

................................................................................................................

3. Colorado Tax, line 17 on Colorado Form 112 ........................................................................................................3.

4. Colorado Payments, line 22 on Colorado Form 112 ............................................................................................. 4.

5. Amount You Owe, line 30 on Colorado Form 112 ................................................................................................ 5.

6. Refund, line 33 Colorado Form 112 ...................................................................................................................... 6.

Part ii — deClaration of taxPaYer

Under penalties of perjury, I declare that I am an officer of the company listed above and the information provided for electronic filing and the amounts

shown in Part I above agree with the amounts shown on the company's 2011 Federal/Colorado income tax returns, and that said tax returns, state-

ments, schedules and attachments are true, correct, and complete to the best of my knowledge and belief. I understand that I (or my Electronic

Return Originator (ERO) if applicable) may be required to provide paper copies of this declaration, my returns, withholding statements, schedules,

and attachments upon request by the Colorado Department of Revenue at any time during the period covered by the Colorado statute of limitations.

Signature

Date

Title

Part iii — deClaration of ero/PreParer/transmitter

If the transmitter did not prepare the tax return, check here

If I am not the preparer, I declare only that the amounts shown in Part I above agree with the amounts shown on the taxpayer's 2011 Federal/

Colorado income tax returns. If I am the preparer, under penalties of perjury I declare that I have reviewed the above taxpayer's 2011 Federal/

Colorado income tax returns and that the information provided to me by the taxpayer and the amounts shown in Part I above agree with the

amounts shown on said tax returns, and that said tax returns, statements, schedules, and attachments are true, correct, and complete to the

best of my knowledge and belief. As preparer, I further declare that I have obtained the taxpayer's signature on this form at the time of filing and

have provided the taxpayer with copies of all forms and information filed. I also agree to maintain this signed form (DR 8453C) for the period

covered by the Colorado statute of limitations, and to provide paper copies of this declaration, said returns, withholding statements, schedules

and attachments upon request by the Colorado Department of Revenue at any time during this period.

ERO's Signature

Your Social Security Number

or Preparer Identification Number

Check if also preparer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2