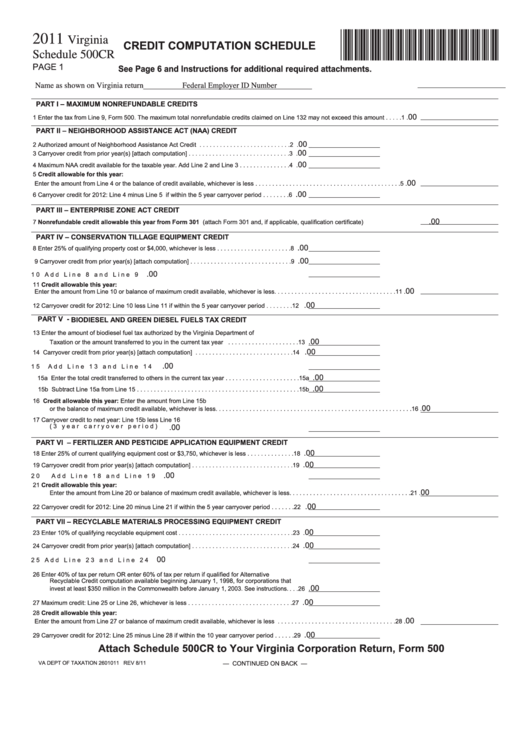

Schedule 500cr - Credit Computation Schedule - 2011

ADVERTISEMENT

*VACPCR111888*

2011

Virginia

CREDIT COMPUTATION SCHEDULE

Schedule 500CR

PAGE 1

See Page 6 and Instructions for additional required attachments.

Name as shown on Virginia return

Federal Employer ID Number

PART I – MAXIMUM NONREFUNDABLE CREDITS

00

1 Enter the tax from Line 9, Form 500. The maximum total nonrefundable credits claimed on Line 132 may not exceed this amount . . . . . 1

.

PART II – NEIGHBORHOOD ASSISTANCE ACT (NAA) CREDIT

00

2 Authorized amount of Neighborhood Assistance Act Credit . . . . . . . . . . . . . . . . . . . . . . . . . . .2

.

00

3 Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

.

00

4 Maximum NAA credit available for the taxable year. Add Line 2 and Line 3 . . . . . . . . . . . . . . .4

.

5 Credit allowable for this year:

00

Enter the amount from Line 4 or the balance of credit available, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.

.00

6 Carryover credit for 2012: Line 4 minus Line 5 if within the 5 year carryover period . . . . . . . .6

PART III – ENTERPRISE ZONE ACT CREDIT

.00

7 Nonrefundable credit allowable this year from Form 301 (attach Form 301 and, if applicable, qualification certificate) . . . . . . . . . . . . 7

PART IV – CONSERVATION TILLAGE EQUIPMENT CREDIT

.00

8 Enter 25% of qualifying property cost or $4,000, whichever is less . . . . . . . . . . . . . . . . . . . . . .8

.00

9 Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9

.00

10 Add Line 8 and Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10

11 Credit allowable this year:

00

Enter the amount from Line 10 or balance of maximum credit available, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.

.00

12 Carryover credit for 2012: Line 10 less Line 11 if within the 5 year carryover period . . . . . . . .12

PART V - BIODIESEL AND GREEN DIESEL FUELS TAX CREDIT

13 Enter the amount of biodiesel fuel tax authorized by the Virginia Department of

.00

Taxation or the amount transferred to you in the current tax year . . . . . . . . . . . . . . . . . . . . .13

.00

14 Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14

.00

15 Add Line 13 and Line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15

.00

15a Enter the total credit transferred to others in the current tax year . . . . . . . . . . . . . . . . . . . . . .15a

.00

15b Subtract Line 15a from Line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15b

16 Credit allowable this year: Enter the amount from Line 15b

00

or the balance of maximum credit available, whichever is less. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

.

17 Carryover credit to next year: Line 15b less Line 16

(3 year carryover period) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .17

.00

PART VI – FERTILIZER AND PESTICIDE APPLICATION EQUIPMENT CREDIT

.00

18 Enter 25% of current qualifying equipment cost or $3,750, whichever is less . . . . . . . . . . . . . .18

.00

19 Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .19

.00

20 Add Line 18 and Line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20

21 Credit allowable this year:

00

Enter the amount from Line 20 or balance of maximum credit available, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

.

.00

22 Carryover credit for 2012: Line 20 minus Line 21 if within the 5 year carryover period . . . . . . .22

PART VII – RECYCLABLE MATERIALS PROCESSING EQUIPMENT CREDIT

00

23 Enter 10% of qualifying recyclable equipment cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .23

.

.00

24 Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .24

00

25 Add Line 23 and Line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .25

.

26 Enter 40% of tax per return OR enter 60% of tax per return if qualified for Alternative

Recyclable Credit computation available beginning January 1, 1998, for corporations that

.00

invest at least $350 million in the Commonwealth before January 1, 2003. See instructions. . . .26

.00

27 Maximum credit: Line 25 or Line 26, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .27

28 Credit allowable this year:

00

Enter the amount from Line 27 or balance of maximum credit available, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

.

.00

29 Carryover credit for 2012: Line 25 minus Line 28 if within the 10 year carryover period . . . . . .29

Attach Schedule 500CR to Your Virginia Corporation Return, Form 500

VA DEPT OF TAXATION 2601011 REV 8/11

— CONTINUED ON BACK —

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6