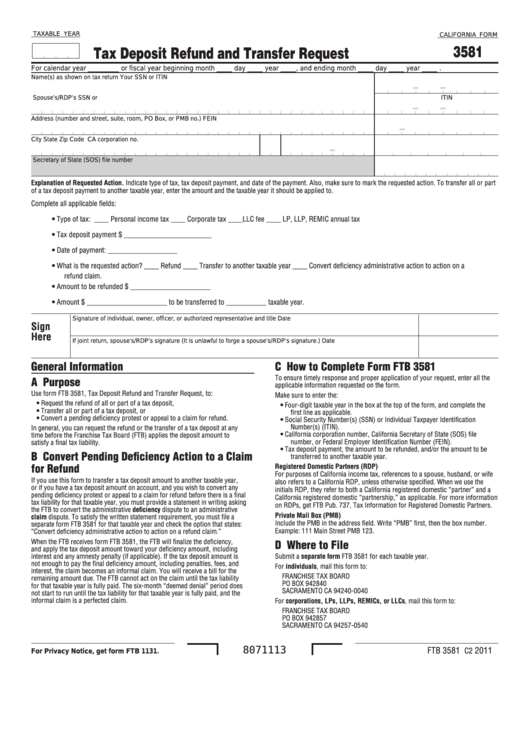

TAXABLE YEAR

CALIFORNIA FORM

3581

Tax Deposit Refund and Transfer Request

For calendar year ________ or fiscal year beginning month ____ day ____ year ____, and ending month ____ day ____ year ____ .

Name(s) as shown on tax return

Your SSN or ITIN

Spouse’s/RDP’s SSN or ITIN

Address (number and street, suite, room, PO Box, or PMB no.)

FEIN

City

State

Zip Code

CA corporation no.

Secretary of State (SOS) file number

Explanation of Requested Action. Indicate type of tax, tax deposit payment, and date of the payment. Also, make sure to mark the requested action. To transfer all or part

of a tax deposit payment to another taxable year, enter the amount and the taxable year it should be applied to.

Complete all applicable fields:

• Type of tax:

____ Personal income tax ____ Corporate tax ____LLC fee ____ LP, LLP, REMIC annual tax

• Tax deposit payment $ ________________________

• Date of payment: ___________________

• What is the requested action? ____ Refund ____ Transfer to another taxable year ____ Convert deficiency administrative action to action on a

refund claim.

• Amount to be refunded $ ______________________

• Amount $ ______________________ to be transferred to ___________ taxable year.

Signature of individual, owner, officer, or authorized representative and title

Date

Sign

Here

If joint return, spouse’s/RDP’s signature (It is unlawful to forge a spouse’s/RDP’s signature.)

Date

General Information

C How to Complete Form FTB 3581

To ensure timely response and proper application of your request, enter all the

A Purpose

applicable information requested on the form.

Use form FTB 3581, Tax Deposit Refund and Transfer Request, to:

Make sure to enter the:

•

Request the refund of all or part of a tax deposit,

•

Four-digit taxable year in the box at the top of the form, and complete the

•

Transfer all or part of a tax deposit, or

first line as applicable.

•

Convert a pending deficiency protest or appeal to a claim for refund.

•

Social Security Number(s) (SSN) or Individual Taxpayer Identification

Number(s) (ITIN).

In general, you can request the refund or the transfer of a tax deposit at any

•

California corporation number, California Secretary of State (SOS) file

time before the Franchise Tax Board (FTB) applies the deposit amount to

number, or Federal Employer Identification Number (FEIN).

satisfy a final tax liability.

•

Tax deposit payment, the amount to be refunded, and/or the amount to be

B Convert Pending Deficiency Action to a Claim

transferred to another taxable year.

for Refund

Registered Domestic Partners (RDP)

For purposes of California income tax, references to a spouse, husband, or wife

If you use this form to transfer a tax deposit amount to another taxable year,

also refers to a California RDP, unless otherwise specified. When we use the

or if you have a tax deposit amount on account, and you wish to convert any

initials RDP, they refer to both a California registered domestic “partner” and a

pending deficiency protest or appeal to a claim for refund before there is a final

California registered domestic “partnership,” as applicable. For more information

tax liability for that taxable year, you must provide a statement in writing asking

on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

the FTB to convert the administrative deficiency dispute to an administrative

Private Mail Box (PMB)

claim dispute. To satisfy the written statement requirement, you must file a

Include the PMB in the address field. Write “PMB” first, then the box number.

separate form FTB 3581 for that taxable year and check the option that states:

Example: 111 Main Street PMB 123.

“Convert deficiency administrative action to action on a refund claim.”

When the FTB receives form FTB 3581, the FTB will finalize the deficiency,

D Where to File

and apply the tax deposit amount toward your deficiency amount, including

interest and any amnesty penalty (if applicable). If the tax deposit amount is

Submit a separate form FTB 3581 for each taxable year.

not enough to pay the final deficiency amount, including penalties, fees, and

For individuals, mail this form to:

interest, the claim becomes an informal claim. You will receive a bill for the

FRANCHISE TAX BOARD

remaining amount due. The FTB cannot act on the claim until the tax liability

PO BOX 942840

for that taxable year is fully paid. The six-month “deemed denial” period does

SACRAMENTO CA 94240-0040

not start to run until the tax liability for that taxable year is fully paid, and the

informal claim is a perfected claim.

For corporations, LPs, LLPs, REMICs, or LLCs, mail this form to:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAMENTO CA 94257-0540

FTB 3581

2011

C2

8071113

For Privacy Notice, get form FTB 1131.

1

1