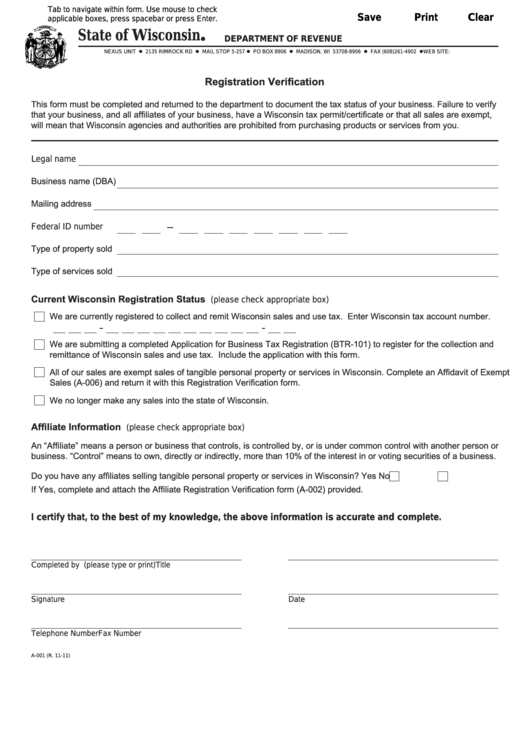

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

State of Wisconsin

l

DEPARTMENT OF REVENUE

NEXUS UNIT l 2135 RIMROCK RD l MAIL STOP 5-257 l PO BOX 8906 l MADISON, WI 53708-8906 l FAX (608)261-4902 l WEB SITE:

Registration Verification

This form must be completed and returned to the department to document the tax status of your business. Failure to verify

that your business, and all affiliates of your business, have a Wisconsin tax permit/certificate or that all sales are exempt,

will mean that Wisconsin agencies and authorities are prohibited from purchasing products or services from you.

Legal name

Business name (DBA)

Mailing address

Federal ID number

Type of property sold

Type of services sold

Current Wisconsin Registration Status

(please check appropriate box)

We are currently registered to collect and remit Wisconsin sales and use tax. Enter Wisconsin tax account number.

We are submitting a completed Application for Business Tax Registration (BTR-101) to register for the collection and

remittance of Wisconsin sales and use tax. Include the application with this form.

All of our sales are exempt sales of tangible personal property or services in Wisconsin. Complete an Affidavit of Exempt

Sales (A-006) and return it with this Registration Verification form.

We no longer make any sales into the state of Wisconsin.

Affiliate Information

(please check appropriate box)

An “Affiliate” means a person or business that controls, is controlled by, or is under common control with another person or

business. “Control” means to own, directly or indirectly, more than 10% of the interest in or voting securities of a business.

Do you have any affiliates selling tangible personal property or services in Wisconsin?

Yes

No

If Yes, complete and attach the Affiliate Registration Verification form (A-002) provided.

I certify that, to the best of my knowledge, the above information is accurate and complete.

Completed by (please type or print)

Title

Signature

Date

Telephone Number

Fax Number

A-001 (R. 11-11)

1

1