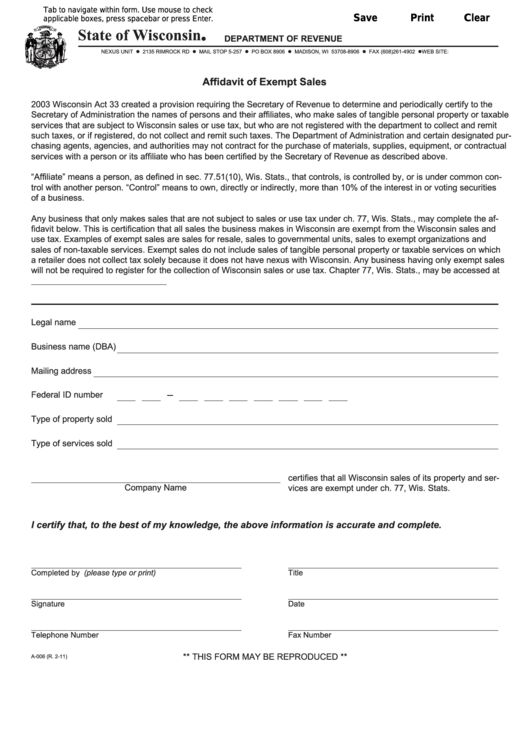

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

State of Wisconsin

DEPARTMENT OF REVENUE

l

NEXUS UNIT l 2135 RIMROCK RD l MAIL STOP 5-257 l PO BOX 8906 l MADISON, WI 53708-8906 l FAX (608) 261-4902 l WEB SITE:

Affidavit of Exempt Sales

2003 Wisconsin Act 33 created a provision requiring the Secretary of Revenue to determine and periodically certify to the

Secretary of Administration the names of persons and their affiliates, who make sales of tangible personal property or taxable

services that are subject to Wisconsin sales or use tax, but who are not registered with the department to collect and remit

such taxes, or if registered, do not collect and remit such taxes. The Department of Administration and certain designated pur-

chasing agents, agencies, and authorities may not contract for the purchase of materials, supplies, equipment, or contractual

services with a person or its affiliate who has been certified by the Secretary of Revenue as described above.

“Affiliate” means a person, as defined in sec. 77.51(10), Wis. Stats., that controls, is controlled by, or is under common con-

trol with another person. “Control” means to own, directly or indirectly, more than 10% of the interest in or voting securities

of a business.

Any business that only makes sales that are not subject to sales or use tax under ch. 77, Wis. Stats., may complete the af-

fidavit below. This is certification that all sales the business makes in Wisconsin are exempt from the Wisconsin sales and

use tax. Examples of exempt sales are sales for resale, sales to governmental units, sales to exempt organizations and

sales of non-taxable services. Exempt sales do not include sales of tangible personal property or taxable services on which

a retailer does not collect tax solely because it does not have nexus with Wisconsin. Any business having only exempt sales

will not be required to register for the collection of Wisconsin sales or use tax. Chapter 77, Wis. Stats., may be accessed at

Legal name

Business name (DBA)

Mailing address

Federal ID number

Type of property sold

Type of services sold

certifies that all Wisconsin sales of its property and ser-

Company Name

vices are exempt under ch. 77, Wis. Stats.

I certify that, to the best of my knowledge, the above information is accurate and complete.

Completed by (please type or print)

Title

Signature

Date

Telephone Number

Fax Number

** THIS FORM MAY BE REPRODUCED **

A-006 (R. 2-11)

1

1