Form A-133 - Surety Bond

ADVERTISEMENT

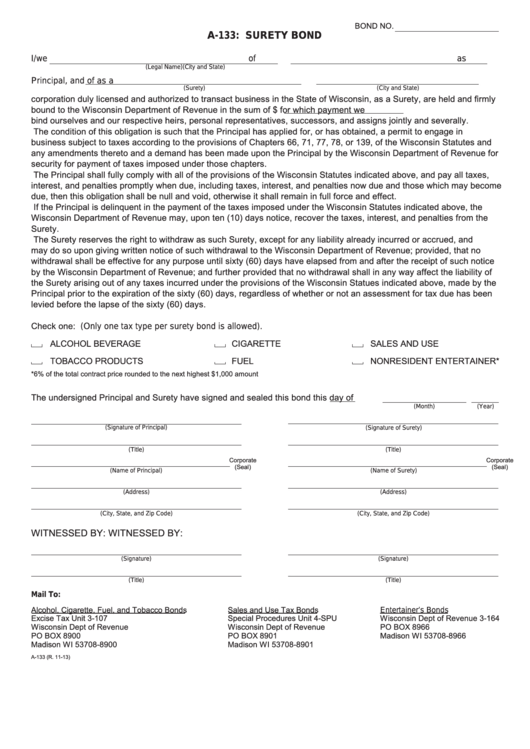

BOND NO.

A-133: SURETY BOND

I/we

of

as

(Legal Name)

(City and State)

Principal, and

of

as a

(Surety)

(City and State)

corporation duly licensed and authorized to transact business in the State of Wisconsin, as a Surety, are held and firmly

bound to the Wisconsin Department of Revenue in the sum of $

for which payment we

bind ourselves and our respective heirs, personal representatives, successors, and assigns jointly and severally.

The condition of this obligation is such that the Principal has applied for, or has obtained, a permit to engage in

business subject to taxes according to the provisions of Chapters 66, 71, 77, 78, or 139, of the Wisconsin Statutes and

any amendments thereto and a demand has been made upon the Principal by the Wisconsin Department of Revenue for

security for payment of taxes imposed under those chapters.

The Principal shall fully comply with all of the provisions of the Wisconsin Statutes indicated above, and pay all taxes,

interest, and penalties promptly when due, including taxes, interest, and penalties now due and those which may become

due, then this obligation shall be null and void, otherwise it shall remain in full force and effect.

If the Principal is delinquent in the payment of the taxes imposed under the Wisconsin Statutes indicated above, the

Wisconsin Department of Revenue may, upon ten (10) days notice, recover the taxes, interest, and penalties from the

Surety.

The Surety reserves the right to withdraw as such Surety, except for any liability already incurred or accrued, and

may do so upon giving written notice of such withdrawal to the Wisconsin Department of Revenue; provided, that no

withdrawal shall be effective for any purpose until sixty (60) days have elapsed from and after the receipt of such notice

by the Wisconsin Department of Revenue; and further provided that no withdrawal shall in any way affect the liability of

the Surety arising out of any taxes incurred under the provisions of the Wisconsin Statues indicated above, made by the

Principal prior to the expiration of the sixty (60) days, regardless of whether or not an assessment for tax due has been

levied before the lapse of the sixty (60) days.

Check one: (Only one tax type per surety bond is allowed).

ALCOHOL BEVERAGE

CIGARETTE

SALES AND USE

TOBACCO PRODUCTS

FUEL

NONRESIDENT ENTERTAINER*

*6% of the total contract price rounded to the next highest $1,000 amount

The undersigned Principal and Surety have signed and sealed this bond this

day of

(Month)

(Year)

(Signature of Principal)

(Signature of Surety)

(Title)

(Title)

Corporate

Corporate

(Seal)

(Seal)

(Name of Principal)

(Name of Surety)

(Address)

(Address)

(City, State, and Zip Code)

(City, State, and Zip Code)

WITNESSED BY:

WITNESSED BY:

(Signature)

(Signature)

(Title)

(Title)

Mail To:

Alcohol, Cigarette, Fuel, and Tobacco Bonds

Sales and Use Tax Bonds

Entertainer’s Bonds

Excise Tax Unit 3-107

Special Procedures Unit 4-SPU

Wisconsin Dept of Revenue 3-164

Wisconsin Dept of Revenue

Wisconsin Dept of Revenue

PO BOX 8966

PO BOX 8900

PO BOX 8901

Madison WI 53708-8966

Madison WI 53708-8900

Madison WI 53708-8901

A-133 (R. 11-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2