Save

Print

Clear

Tab to navigate within form.

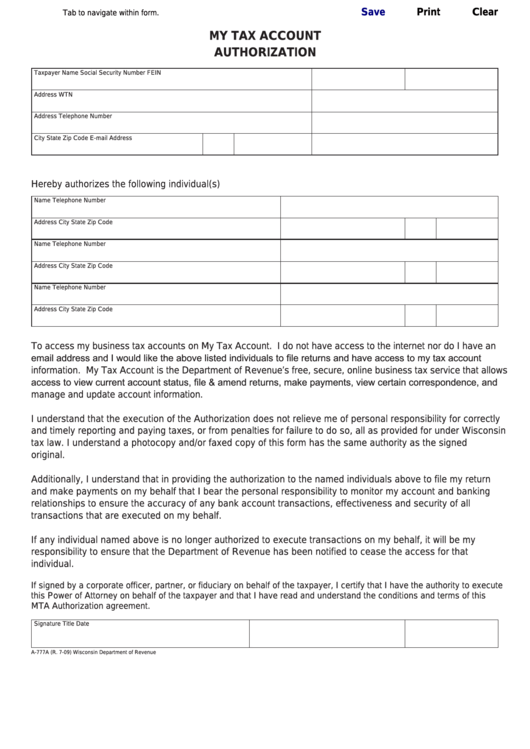

MY TAX ACCOUNT

AUTHORIZATION

Taxpayer Name

Social Security Number

FEIN

Address

WTN

Address

Telephone Number

City

State

Zip Code

E-mail Address

Hereby authorizes the following individual(s)

Name

Telephone Number

Address

City

State

Zip Code

Name

Telephone Number

Address

City

State

Zip Code

Name

Telephone Number

Address

City

State

Zip Code

To access my business tax accounts on My Tax Account. I do not have access to the internet nor do I have an

email address and I would like the above listed individuals to file returns and have access to my tax account

information. My Tax Account is the Department of Revenue’s free, secure, online business tax service that allows

access to view current account status, file & amend returns, make payments, view certain correspondence, and

manage and update account information.

I understand that the execution of the Authorization does not relieve me of personal responsibility for correctly

and timely reporting and paying taxes, or from penalties for failure to do so, all as provided for under Wisconsin

tax law. I understand a photocopy and/or faxed copy of this form has the same authority as the signed

original.

Additionally, I understand that in providing the authorization to the named individuals above to file my return

and make payments on my behalf that I bear the personal responsibility to monitor my account and banking

relationships to ensure the accuracy of any bank account transactions, effectiveness and security of all

transactions that are executed on my behalf.

If any individual named above is no longer authorized to execute transactions on my behalf, it will be my

responsibility to ensure that the Department of Revenue has been notified to cease the access for that

individual.

If signed by a corporate officer, partner, or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute

this Power of Attorney on behalf of the taxpayer and that I have read and understand the conditions and terms of this

MTA Authorization agreement.

Signature

Title

Date

A-777A (R. 7-09)

Wisconsin Department of Revenue

1

1 2

2