Form Nys-100g - New York State Employer Registration For Unemployment Insurance, Withholding, And Wage Reporting For Governmental Entities

ADVERTISEMENT

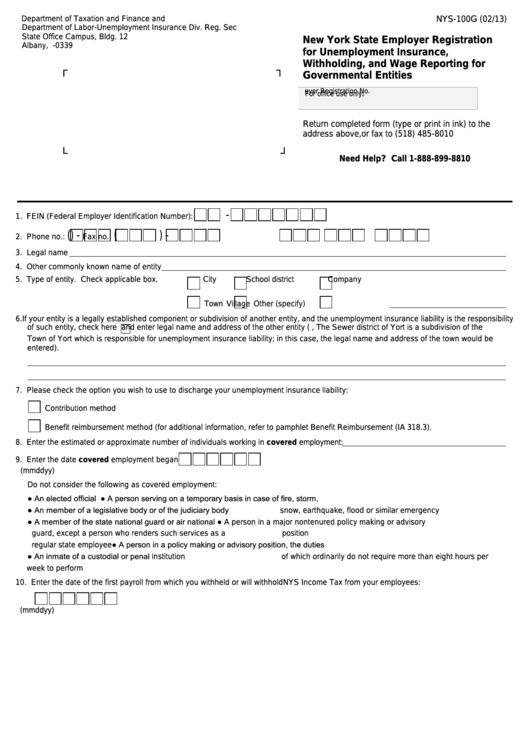

Department of Taxation and Finance and

NYS-100G (02/13)

Department of Labor-Unemployment Insurance Div. Reg. Sec

State Office Campus, Bldg. 12

New York State Employer Registration

Albany, N.Y. 12240-0339

for Unemployment Insurance,

Withholding, and Wage Reporting for

┌

┐

Governmental Entities

For office use only:

U.I. Employer Registration No.

Return completed form (type or print in ink) to the

address above, or fax to (518) 485-8010

└

┘

Need Help? Call 1-888-899-8810

-

1. FEIN (Federal Employer Identification Number):

(

(

)

-

)

-

2. Phone no.:

Fax no.:

3. Legal name

4. Other commonly known name of entity

5. Type of entity. Check applicable box.

City

School district

Company

Town

Village

Other (specify)

6. If your entity is a legally established component or subdivision of another entity, and the unemployment insurance liability is the responsibility

of such entity, check here

and enter legal name and address of the other entity (e.g., The Sewer district of Yort is a subdivision of the

Town of Yort which is responsible for unemployment insurance liability; in this case, the legal name and address of the town would be

entered).

7. Please check the option you wish to use to discharge your unemployment insurance liability:

Contribution method

Benefit reimbursement method (for additional information, refer to pamphlet Benefit Reimbursement (IA 318.3).

8. Enter the estimated or approximate number of individuals working in covered employment:

9. Enter the date covered employment began

(mmddyy)

Do not consider the following as covered employment:

● An elected official

● A person serving on a temporary basis in case of fire, storm,

● An member of a legislative body or of the judiciary body

snow, earthquake, flood or similar emergency

● A member of the state national guard or air national

● A person in a major nontenured policy making or advisory

guard, except a person who renders such services as a

position

● A person in a policy making or advisory position, the duties

regular state employee

● An inmate of a custodial or penal institution

of which ordinarily do not require more than eight hours per

week to perform

10. Enter the date of the first payroll from which you withheld or will withhold NYS Income Tax from your employees:

(mmddyy)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2