Form Dr-145 - Oil Production Monthly Tax Return - Florida Department Of Revenue

ADVERTISEMENT

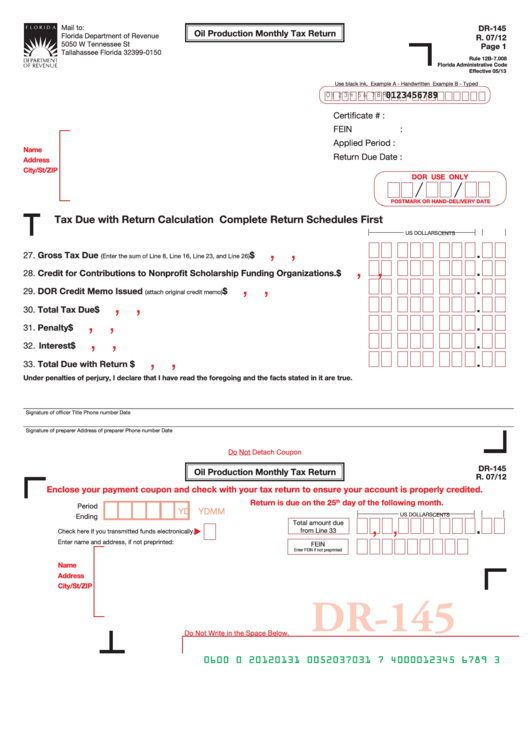

Mail to:

DR-145

Oil Production Monthly Tax Return

Florida Department of Revenue

R. 07/12

5050 W Tennessee St

Page 1

Tallahassee Florida 32399-0150

Rule 12B-7.008

Florida Administrative Code

Effective 05/13

Use black ink. Example A - Handwritten Example B - Typed

0 1 2 3 4 5 6 7 8 9

0123456789

Certificate #

:

FEIN

:

Applied Period

:

Name

Return Due Date :

Address

City/St/ZIP

DOR USE ONLY

POSTMARK OR HAND-DELIVERY DATE

Tax Due with Return Calculation

Complete Return Schedules First

US DOLLARS

CENTS

,

,

27. Gross Tax Due

.......................................... $

(Enter the sum of Line 8, Line 16, Line 23, and Line 26)

,

,

28. Credit for Contributions to Nonprofit Scholarship Funding Organizations. ..... $

,

,

29. DOR Credit Memo Issued

.................................................... $

(attach original credit memo)

,

,

30. Total Tax Due .......................................................................................................... $

,

,

31. Penalty .................................................................................................................... $

,

,

32. Interest .................................................................................................................... $

,

,

33. Total Due with Return ........................................................................................... $

Under penalties of perjury, I declare that I have read the foregoing and the facts stated in it are true.

___________________________________________________________________________________________________________________________________________

Signature of officer

Title

Phone number

Date

___________________________________________________________________________________________________________________________________________

Signature of preparer

Address of preparer

Phone number

Date

Do Not Detach Coupon

DR-145

Oil Production Monthly Tax Return

R. 07/12

Enclose your payment coupon and check with your tax return to ensure your account is properly credited.

Return is due on the 25

day of the following month.

th

Period

M

M

D

D Y

Y

US DOLLARS

CENTS

Ending

,

,

Total amount due

from Line 33

Check here if you transmitted funds electronically.

Enter name and address, if not preprinted:

FEIN

Enter FEIN if not preprinted

Name

Address

City/St/ZIP

DR-145

Do Not Write in the Space Below.

0600 0 20120131 0052037031 7 4000012345 6789 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6