Form Dr-15ezn Instructions - Sales And Use Tax Returns - Florida Department Of Revenue

ADVERTISEMENT

Instructions for

DR-15EZN

R. 01/15

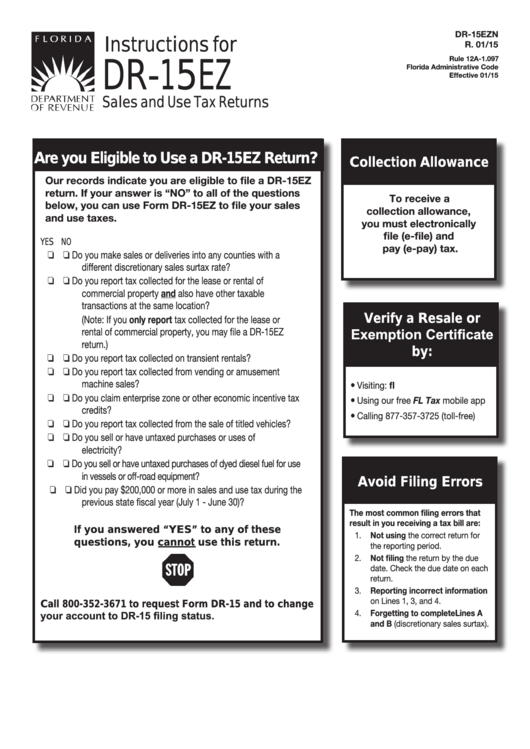

DR-15EZ

Rule 12A-1.097

Florida Administrative Code

Effective 01/15

Sales and Use Tax Returns

Are you Eligible to Use a DR-15EZ Return?

Collection Allowance

Our records indicate you are eligible to file a DR-15EZ

return. If your answer is “NO” to all of the questions

To receive a

below, you can use Form DR-15EZ to file your sales

collection allowance,

and use taxes.

you must electronically

file (e-file) and

YES NO

pay (e-pay) tax.

Do you make sales or deliveries into any counties with a

o o

different discretionary sales surtax rate?

Do you report tax collected for the lease or rental of

o o

commercial property and also have other taxable

transactions at the same location?

(Note: If you only report tax collected for the lease or

Verify a Resale or

Exemption Certificate

rental of commercial property, you may file a DR-15EZ

return.)

by:

Do you report tax collected on transient rentals?

o o

Do you report tax collected from vending or amusement

o o

machine sales?

Visiting:

l

Do you claim enterprise zone or other economic incentive tax

o o

Using our free FL Tax mobile app

l

credits?

Calling 877-357-3725 (toll-free)

l

Do you report tax collected from the sale of titled vehicles?

o o

Do you sell or have untaxed purchases or uses of

o o

electricity?

Do you sell or have untaxed purchases of dyed diesel fuel for use

o o

in vessels or off-road equipment?

Avoid Filing Errors

Did you pay $200,000 or more in sales and use tax during the

o o

previous state fiscal year (July 1 - June 30)?

The most common filing errors that

result in you receiving a tax bill are:

If you answered “YES” to any of these

1. Not using the correct return for

questions, you cannot use this return.

the reporting period.

2. Not filing the return by the due

date. Check the due date on each

return.

3. Reporting incorrect information

on Lines 1, 3, and 4.

Call 800-352-3671 to request Form DR-15 and to change

4. Forgetting to complete Lines A

your account to DR-15 filing status.

and B (discretionary sales surtax).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6