Form Dr-191 - Application For Aviation Fuel Tax Refund Air Carriers

ADVERTISEMENT

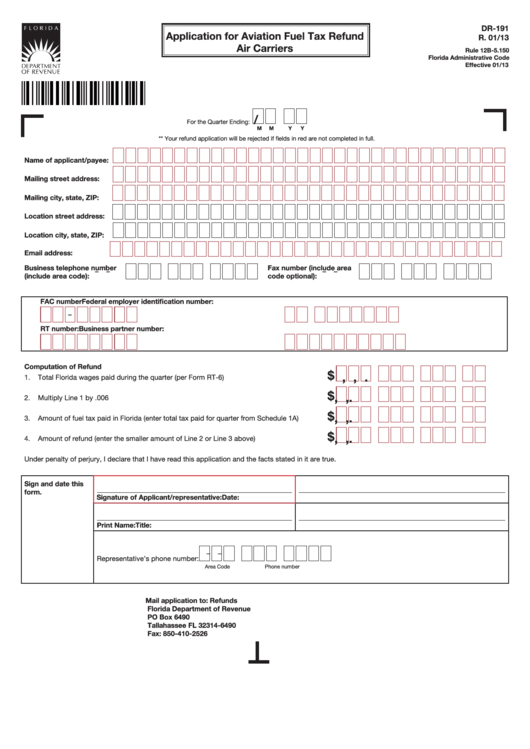

DR-191

Application for Aviation Fuel Tax Refund

R. 01/13

Air Carriers

Rule 12B-5.150

Florida Administrative Code

Effective 01/13

/

For the Quarter Ending:

M

M

Y

Y

** Your refund application will be rejected if fields in red are not completed in full.

Name of applicant/payee:

Mailing street address:

Mailing city, state, ZIP:

Location street address:

Location city, state, ZIP:

Email address:

Business telephone number

Fax number (include area

–

–

–

–

(include area code):

code optional):

FAC number

Federal employer identification number:

–

RT number:

Business partner number:

Computation of Refund

$

,

,

.

1.

Total Florida wages paid during the quarter (per Form RT-6)

$

,

,

.

2.

Multiply Line 1 by .006

$

,

,

.

3.

Amount of fuel tax paid in Florida (enter total tax paid for quarter from Schedule 1A)

$

,

,

.

4.

Amount of refund (enter the smaller amount of Line 2 or Line 3 above)

Under penalty of perjury, I declare that I have read this application and the facts stated in it are true.

Sign and date this

form.

Signature of Applicant/representative:

Date:

Print Name:

Title:

–

–

Representative’s phone number:

Area Code

Phone number

Mail application to:

Refunds

Florida Department of Revenue

PO Box 6490

Tallahassee FL 32314-6490

Fax: 850-410-2526

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3