Form Dr-300400 - Boat, Motor Vehicle, Or Aircraft Dealer Application For Special Estimation Of Taxes

ADVERTISEMENT

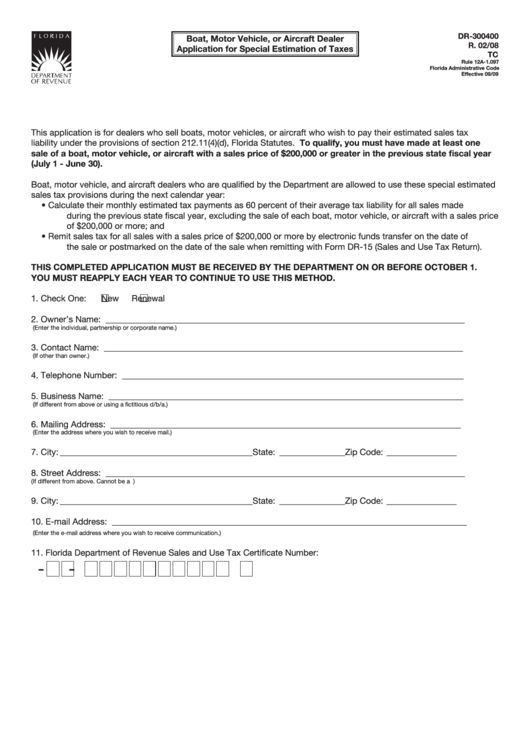

DR-300400

Boat, Motor Vehicle, or Aircraft Dealer

R. 02/08

Application for Special Estimation of Taxes

TC

Rule 12A-1.097

Florida Administrative Code

Effective 09/09

This application is for dealers who sell boats, motor vehicles, or aircraft who wish to pay their estimated sales tax

liability under the provisions of section 212.11(4)(d), Florida Statutes. To qualify, you must have made at least one

sale of a boat, motor vehicle, or aircraft with a sales price of $200,000 or greater in the previous state fiscal year

(July 1 - June 30).

Boat, motor vehicle, and aircraft dealers who are qualified by the Department are allowed to use these special estimated

sales tax provisions during the next calendar year:

•

Calculate their monthly estimated tax payments as 60 percent of their average tax liability for all sales made

during the previous state fiscal year, excluding the sale of each boat, motor vehicle, or aircraft with a sales price

of $200,000 or more; and

•

Remit sales tax for all sales with a sales price of $200,000 or more by electronic funds transfer on the date of

the sale or postmarked on the date of the sale when remitting with Form DR-15 (Sales and Use Tax Return).

THIS COMPLETED APPLICATION MUST BE RECEIVED BY THE DEPARTMENT ON OR BEFORE OCTOBER 1.

YOU MUST REAPPLY EACH YEAR TO CONTINUE TO USE THIS METHOD.

■

■

1. Check One:

New

Renewal

2. Owner’s Name: __________________________________________________________________________________

(Enter the individual, partnership or corporate name.)

3. Contact Name: __________________________________________________________________________________

(If other than owner.)

4. Telephone Number: ______________________________________________________________________________

5. Business Name: _________________________________________________________________________________

(If different from above or using a fictitious d/b/a.)

6. Mailing Address: ________________________________________________________________________________

(Enter the address where you wish to receive mail.)

7. City: ____________________________________________ State: _______________ Zip Code: ________________

8. Street Address: __________________________________________________________________________________

(If different from above. Cannot be a P.O.Box.)

9. City: ____________________________________________ State: _______________ Zip Code: ________________

10. E-mail Address: _________________________________________________________________________________

(Enter the e-mail address where you wish to receive communication.)

11. Florida Department of Revenue Sales and Use Tax Certificate Number:

-

-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2