Form Dr-309633n Instructions - Filing Mass Transit System Provider Fuel Tax Return - 2015

ADVERTISEMENT

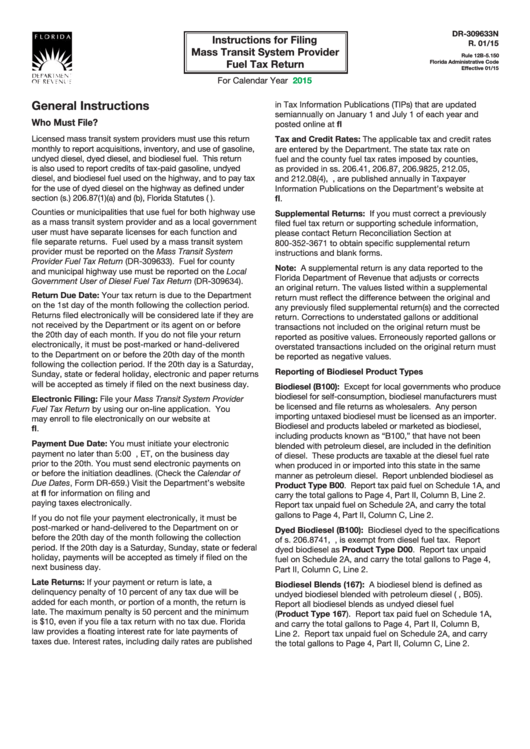

DR-309633N

Instructions for Filing

R. 01/15

Mass Transit System Provider

Rule 12B-5.150

Fuel Tax Return

Florida Administrative Code

Effective 01/15

2015

For Calendar Year

General Instructions

in Tax Information Publications (TIPs) that are updated

semiannually on January 1 and July 1 of each year and

Who Must File?

posted online at

Licensed mass transit system providers must use this return

Tax and Credit Rates: The applicable tax and credit rates

monthly to report acquisitions, inventory, and use of gasoline,

are entered by the Department. The state tax rate on

undyed diesel, dyed diesel, and biodiesel fuel. This return

fuel and the county fuel tax rates imposed by counties,

is also used to report credits of tax-paid gasoline, undyed

as provided in ss. 206.41, 206.87, 206.9825, 212.05,

diesel, and biodiesel fuel used on the highway, and to pay tax

and 212.08(4), F.S., are published annually in Taxpayer

for the use of dyed diesel on the highway as defined under

Information Publications on the Department’s website at

section (s.) 206.87(1)(a) and (b), Florida Statutes (F.S.).

Counties or municipalities that use fuel for both highway use

Supplemental Returns: If you must correct a previously

as a mass transit system provider and as a local government

filed fuel tax return or supporting schedule information,

user must have separate licenses for each function and

please contact Return Reconciliation Section at

file separate returns. Fuel used by a mass transit system

800-352-3671 to obtain specific supplemental return

provider must be reported on the Mass Transit System

instructions and blank forms.

Provider Fuel Tax Return (DR-309633). Fuel for county

Note: A supplemental return is any data reported to the

and municipal highway use must be reported on the Local

Florida Department of Revenue that adjusts or corrects

Government User of Diesel Fuel Tax Return (DR-309634).

an original return. The values listed within a supplemental

Return Due Date: Your tax return is due to the Department

return must reflect the difference between the original and

on the 1st day of the month following the collection period.

any previously filed supplemental return(s) and the corrected

Returns filed electronically will be considered late if they are

return. Corrections to understated gallons or additional

not received by the Department or its agent on or before

transactions not included on the original return must be

the 20th day of each month. If you do not file your return

reported as positive values. Erroneously reported gallons or

electronically, it must be post-marked or hand-delivered

overstated transactions included on the original return must

to the Department on or before the 20th day of the month

be reported as negative values.

following the collection period. If the 20th day is a Saturday,

Reporting of Biodiesel Product Types

Sunday, state or federal holiday, electronic and paper returns

will be accepted as timely if filed on the next business day.

Biodiesel (B100): Except for local governments who produce

biodiesel for self-consumption, biodiesel manufacturers must

Electronic Filing: File your Mass Transit System Provider

be licensed and file returns as wholesalers. Any person

Fuel Tax Return by using our on-line application. You

importing untaxed biodiesel must be licensed as an importer.

may enroll to file electronically on our website at

Biodiesel and products labeled or marketed as biodiesel,

including products known as “B100,” that have not been

Payment Due Date: You must initiate your electronic

blended with petroleum diesel, are included in the definition

payment no later than 5:00 p.m., ET, on the business day

of diesel. These products are taxable at the diesel fuel rate

prior to the 20th. You must send electronic payments on

when produced in or imported into this state in the same

or before the initiation deadlines. (Check the Calendar of

manner as petroleum diesel. Report unblended biodiesel as

Due Dates, Form DR-659.) Visit the Department’s website

Product Type B00. Report tax paid fuel on Schedule 1A, and

at for information on filing and

carry the total gallons to Page 4, Part II, Column B, Line 2.

paying taxes electronically.

Report tax unpaid fuel on Schedule 2A, and carry the total

gallons to Page 4, Part II, Column C, Line 2.

If you do not file your payment electronically, it must be

post-marked or hand-delivered to the Department on or

Dyed Biodiesel (B100): Biodiesel dyed to the specifications

before the 20th day of the month following the collection

of s. 206.8741, F.S., is exempt from diesel fuel tax. Report

period. If the 20th day is a Saturday, Sunday, state or federal

dyed biodiesel as Product Type D00. Report tax unpaid

holiday, payments will be accepted as timely if filed on the

fuel on Schedule 2A, and carry the total gallons to Page 4,

next business day.

Part II, Column C, Line 2.

Late Returns: If your payment or return is late, a

Biodiesel Blends (167): A biodiesel blend is defined as

delinquency penalty of 10 percent of any tax due will be

undyed biodiesel blended with petroleum diesel (i.e., B05).

added for each month, or portion of a month, the return is

Report all biodiesel blends as undyed diesel fuel

late. The maximum penalty is 50 percent and the minimum

(Product Type 167). Report tax paid fuel on Schedule 1A,

is $10, even if you file a tax return with no tax due. Florida

and carry the total gallons to Page 4, Part II, Column B,

law provides a floating interest rate for late payments of

Line 2. Report tax unpaid fuel on Schedule 2A, and carry

taxes due. Interest rates, including daily rates are published

the total gallons to Page 4, Part II, Column C, Line 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4