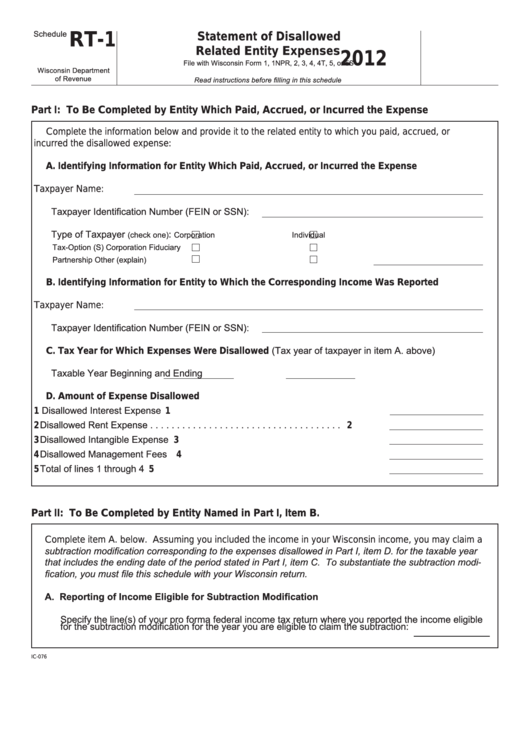

Schedule

RT-1

Statement of Disallowed

Related Entity Expenses

2012

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5, or 5S

Wisconsin Department

of Revenue

Read instructions before filling in this schedule

Part I: To Be Completed by Entity Which Paid, Accrued, or Incurred the Expense

Complete the information below and provide it to the related entity to which you paid, accrued, or

incurred the disallowed expense:

A. Identifying Information for Entity Which Paid, Accrued, or Incurred the Expense

Taxpayer Name:

Taxpayer Identification Number (FEIN or SSN):

Type of Taxpayer

(check one)

Corporation

Individual

:

Tax-Option (S) Corporation

Fiduciary

Partnership

Other (explain)

B. Identifying Information for Entity to Which the Corresponding Income Was Reported

Taxpayer Name:

Taxpayer Identification Number (FEIN or SSN):

C. Tax Year for Which Expenses Were Disallowed (Tax year of taxpayer in item A. above)

Taxable Year Beginning

and Ending

D. Amount of Expense Disallowed

1 Disallowed Interest Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Disallowed Rent Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Disallowed Intangible Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Disallowed Management Fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Total of lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Part II: To Be Completed by Entity Named in Part I, Item B.

Complete item A. below. Assuming you included the income in your Wisconsin income, you may claim a

subtraction modification corresponding to the expenses disallowed in Part I, item D. for the taxable year

that includes the ending date of the period stated in Part I, item C. To substantiate the subtraction modi-

fication, you must file this schedule with your Wisconsin return.

A. Reporting of Income Eligible for Subtraction Modification

Specify the line(s) of your pro forma federal income tax return where you reported the income eligible

for the subtraction modification for the year you are eligible to claim the subtraction:

IC-076

1

1