DR-405, R. 12/11, page 3

INSTRUCTIONS

Complete this form if you own property used for commercial purposes that is not included in the assessed value of

your business' real property. This may include office furniture, computers, tools, supplies, machines, and

leasehold improvements. Return this to your property appraiser's office by April 1. Keep a copy for your records.

Report your summary totals on page 1. Use page 2 or an attached, itemized list with original cost and date

acquired for each item to provide the details for each category. Contact your local property appraiser if you

have questions.

If you ask, the property appraiser will give you an extension for 30 days and may grant an additional 15 days.

You must ask for the extension in time for the property appraiser to consider the request and act on it before

April 1.

Each return is eligible for an exemption up to $25,000. By filing a DR-405 on time you automatically apply for

the exemption. If you do not file on time, Florida Law provides for the loss of the $25,000 exemption.

WHAT TO REPORT

LOCATION OF PERSONAL PROPERTY

Include on your return:

Report all property located in this county on January

1. You must file a single return for each site in the

1. Tangible Personal Property. Goods, chattels, and

county where you transact business. If you have

other articles of value (except certain vehicles)

freestanding property at multiple sites other than

that can be manually possessed and whose chief

where you transact business, file a separate, but

value is intrinsic to the article itself.

single, return for all such property located in the

2. Inventory held for lease. Examples: equipment,

county.

furniture, or fixtures after their first lease or rental.

Examples of freestanding property at multiple sites

3. Equipment on some vehicles. Examples: power

include vending and amusement machines, LP/

cranes, air compressors, and other equipment used

propane tanks, utility and cable company property,

primarily as a tool rather than a hauling vehicle.

billboards, leased equipment, and similar property

4. Property personally owned, but used in the

not customarily located in the offices, stores, or plants

business.

of the owner, but is placed throughout the county.

5. Fully depreciated items, whether written off or

not. Report at original installed cost.

PENALTIES

Failure to file - 25% of the total tax levied against

Do not include:

the property for each year that no return is filed

1. Intangible Personal Property. Examples: money,

Filing late - 5% of the total tax levied against the

all evidences of debt owed to the taxpayer, all

property covered by that return for each year, each

evidence of ownership in a corporation.

month, and part of a month, that a return is late, but

2. Household Goods. Examples: wearing apparel,

not more than 25% of the total tax

appliances, furniture, and other items ordinarily

found in the home and used for the comfort of

Unlisted property -15% of the tax attributable to the

the owner and his family, and not used for

omitted property

commercial purposes.

RELATED FLORIDA TAX LAWS

3. Most automobiles, trucks, and other licensed

vehicles. See 3 above.

§192.042, F.S. - Assessment date: Jan 1

§193.052, F.S. - Filing requirement

4. Inventory that is for sale as part of your business.

§193.062, F.S. - Filing date: April 1

Items commonly referred to as goods, wares,

§193.063, F.S. - Extensions for filing

and merchandise that are held for sale.

§193.072, F.S. - Penalties

§193.074, F.S. - Confidentiality

§195.027(4), F.S.- Return Requirements

§196.183, F.S. - $25,000 Exemption

§ 837.06, F.S. - False Official Statements

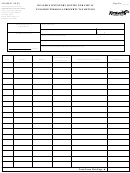

See line and column instructions on page 4.

1

1 2

2 3

3 4

4