Form Dr-501a - Statement Of Gross Income

ADVERTISEMENT

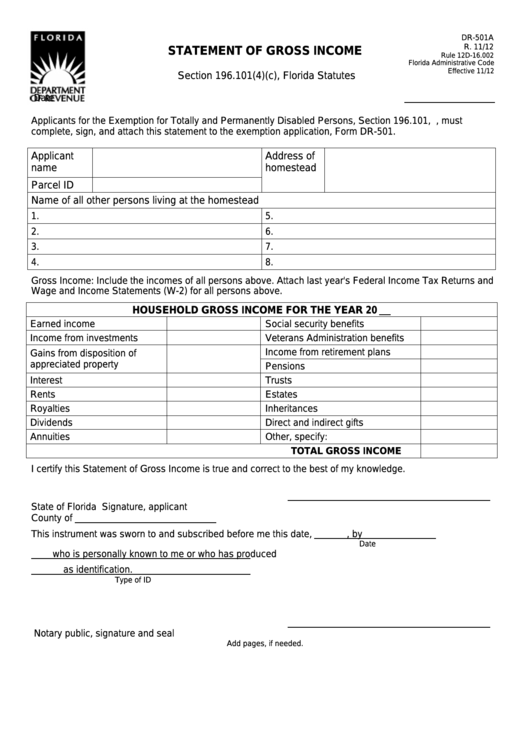

DR-501A

R. 11/12

STATEMENT OF GROSS INCOME

Rule 12D-16.002

Florida Administrative Code

Effective 11/12

Section 196.101(4)(c), Florida Statutes

Date

Applicants for the Exemption for Totally and Permanently Disabled Persons, Section 196.101, F.S., must

complete, sign, and attach this statement to the exemption application, Form DR-501.

Applicant

Address of

name

homestead

Parcel ID

Name of all other persons living at the homestead

1.

5.

2.

6.

3.

7.

4.

8.

Gross Income: Include the incomes of all persons above. Attach last year's Federal Income Tax Returns and

Wage and Income Statements (W-2) for all persons above.

HOUSEHOLD GROSS INCOME FOR THE YEAR 20

Earned income

Social security benefits

Income from investments

Veterans Administration benefits

Income from retirement plans

Gains from disposition of

appreciated property

Pensions

Interest

Trusts

Rents

Estates

Royalties

Inheritances

Dividends

Direct and indirect gifts

Annuities

Other, specify:

TOTAL GROSS INCOME

I certify this Statement of Gross Income is true and correct to the best of my knowledge.

State of Florida

Signature, applicant

County of

This instrument was sworn to and subscribed before me this date,

, by

Date

who is personally known to me or who has produced

as identification.

Type of ID

Notary public, signature and seal

Add pages, if needed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1