Form Dr-501t - Transfer Of Homestead Assessment Difference

ADVERTISEMENT

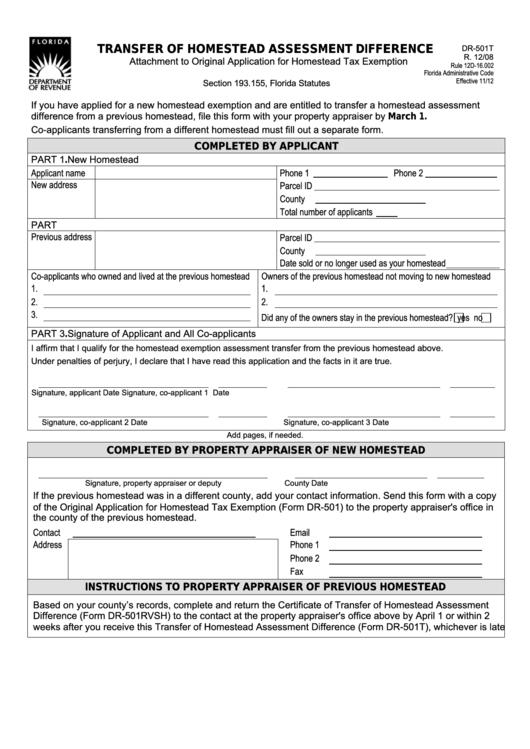

DR-501T

TRANSFER OF HOMESTEAD ASSESSMENT DIFFERENCE

R. 12/08

Attachment to Original Application for Homestead Tax Exemption

Rule 12D-16.002

Florida Administrative Code

Effective 11/12

Section 193.155, Florida Statutes

If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment

difference from a previous homestead, file this form with your property appraiser by March 1.

Co-applicants transferring from a different homestead must fill out a separate form.

COMPLETED BY APPLICANT

PART 1. New Homestead

Applicant name

Phone 1

Phone 2

New address

Parcel ID

County

Total number of applicants

PART 2. Previous Homestead

Previous address

Parcel ID

County

Date sold or no longer used as your homestead

Co-applicants who owned and lived at the previous homestead

Owners of the previous homestead not moving to new homestead

1.

1.

2.

2.

3.

Did any of the owners stay in the previous homestead?

yes

no

PART 3. Signature of Applicant and All Co-applicants

I affirm that I qualify for the homestead exemption assessment transfer from the previous homestead above.

Under penalties of perjury, I declare that I have read this application and the facts in it are true.

Signature, applicant

Date

Signature, co-applicant 1

Date

Signature, co-applicant 2

Date

Signature, co-applicant 3

Date

Add pages, if needed.

COMPLETED BY PROPERTY APPRAISER OF NEW HOMESTEAD

Signature, property appraiser or deputy

County

Date

If the previous homestead was in a different county, add your contact information. Send this form with a copy

of the Original Application for Homestead Tax Exemption (Form DR-501) to the property appraiser's office in

the county of the previous homestead.

Contact

Email

Address

Phone 1

Phone 2

Fax

INSTRUCTIONS TO PROPERTY APPRAISER OF PREVIOUS HOMESTEAD

Based on your county’s records, complete and return the Certificate of Transfer of Homestead Assessment

Difference (Form DR-501RVSH) to the contact at the property appraiser's office above by April 1 or within 2

weeks after you receive this Transfer of Homestead Assessment Difference (Form DR-501T), whichever is later.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1