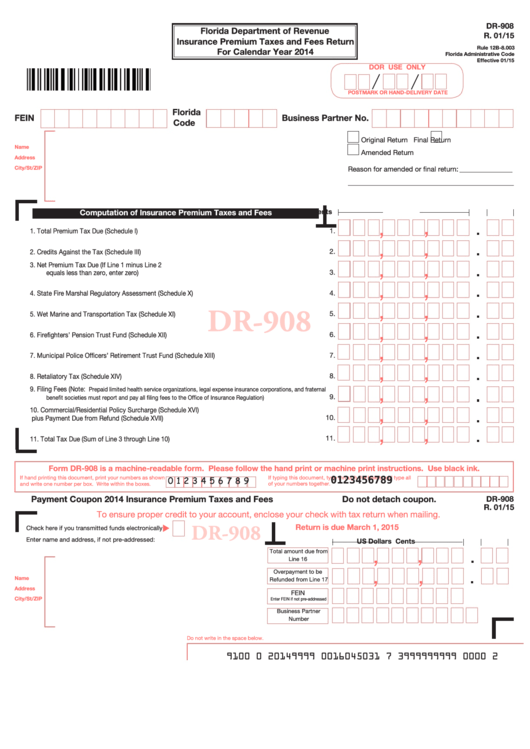

Form Dr-908 - Insurance Premium Taxes And Fees Return - 2014

ADVERTISEMENT

DR-908

Florida Department of Revenue

R. 01/15

Insurance Premium Taxes and Fees Return

Rule 12B-8.003

For Calendar Year 2014

Florida Administrative Code

Effective 01/15

DOR USE ONLY

POSTMARK OR HAND-DELIVERY DATE

Florida

FEIN

Business Partner No.

Code

Original Return

Final Return

Name

Amended Return

Address

City/St/ZIP

Reason for amended or final return: _______________

_______________________________________________

Computation of Insurance Premium Taxes and Fees

US Dollars

Cents

,

,

1.

Total Premium Tax Due (Schedule I) .....................................................................................................

1.

,

,

2.

Credits Against the Tax (Schedule III) ...................................................................................................

2.

,

,

3.

Net Premium Tax Due (If Line 1 minus Line 2

equals less than zero, enter zero) .........................................................................................................

3.

,

,

4.

State Fire Marshal Regulatory Assessment (Schedule X) ......................................................................

4.

,

,

DR-908

5.

Wet Marine and Transportation Tax (Schedule XI) .................................................................................

5.

,

,

6.

Firefighters’ Pension Trust Fund (Schedule XII) .....................................................................................

6.

,

,

7.

Municipal Police Officers’ Retirement Trust Fund (Schedule XIII) ..........................................................

7.

,

,

8.

Retaliatory Tax (Schedule XIV) ...............................................................................................................

8.

,

,

9.

Filing Fees (Note:

Prepaid limited health service organizations, legal expense insurance corporations, and fraternal

9.

....................................

benefit societies must report and pay all filing fees to the Office of Insurance Regulation)

,

,

10.

Commercial/Residential Policy Surcharge (Schedule XVI)

10.

plus Payment Due from Refund (Schedule XVII) ....................................................................................

,

,

11.

11.

Total Tax Due (Sum of Line 3 through Line 10) ......................................................................................

Form DR-908 is a machine-readable form. Please follow the hand print or machine print instructions. Use black ink.

0 1 2 3 4 5 6 7 8 9

If hand printing this document, print your numbers as shown

If typing this document, type through the boxes and type all

0123456789

and write one number per box. Write within the boxes.

of your numbers together.

Payment Coupon 2014 Insurance Premium Taxes and Fees

Do not detach coupon.

DR-908

R. 01/15

To ensure proper credit to your account, enclose your check with tax return when mailing.

DR-908

Return is due March 1, 2015

Check here if you transmitted funds electronically

Enter name and address, if not pre-addressed:

US Dollars

Cents

,

,

Total amount due from

Line 16

,

,

Overpayment to be

Name

Refunded from Line 17

Address

FEIN

City/St/ZIP

Enter FEIN if not pre-addressed

Business Partner

Number

Do not write in the space below.

9100 0 20149999 0016045031 7 3999999999 0000 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12