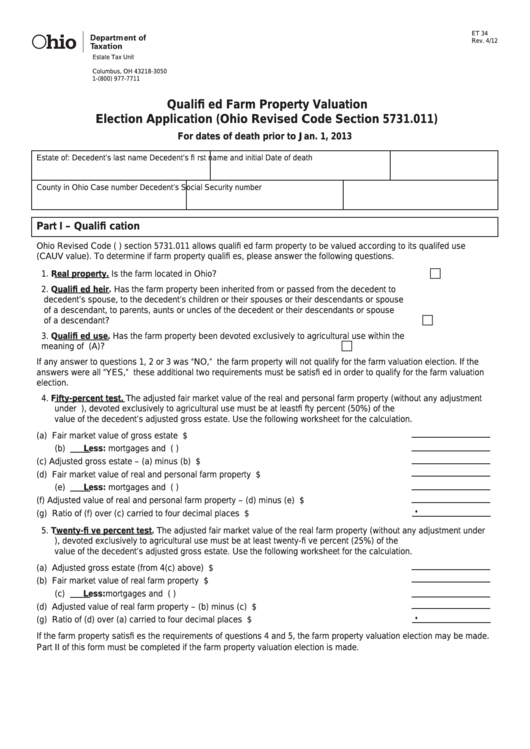

ET 34

Rev. 4/12

Estate Tax Unit

P.O. Box 183050

Columbus, OH 43218-3050

Reset Form

1-(800) 977-7711

tax.ohio.gov

Qualifi ed Farm Property Valuation

Election Application (Ohio Revised Code Section 5731.011)

For dates of death prior to Jan. 1, 2013

Estate of: Decedent’s last name

Decedent’s fi rst name and initial

Date of death

County in Ohio

Case number

Decedent’s Social Security number

Part I – Qualifi cation

Ohio Revised Code (R.C.) section 5731.011 allows qualifi ed farm property to be valued according to its qualifed use

(CAUV value). To determine if farm property qualifi es, please answer the following questions.

1. Real property. Is the farm located in Ohio?

Yes

No

2. Qualifi ed heir. Has the farm property been inherited from or passed from the decedent to

decedent’s spouse, to the decedent’s children or their spouses or their descendants or spouse

of a descendant, to parents, aunts or uncles of the decedent or their descendants or spouse

of a descendant?

Yes

No

3. Qualifi ed use. Has the farm property been devoted exclusively to agricultural use within the

meaning of R.C. section 5713.30(A)?

Yes

No

If any answer to questions 1, 2 or 3 was “NO,” the farm property will not qualify for the farm valuation election. If the

answers were all “YES,” these additional two requirements must be satisfi ed in order to qualify for the farm valuation

election.

4. Fifty-percent test. The adjusted fair market value of the real and personal farm property (without any adjustment

under R.C. section 5731.011), devoted exclusively to agricultural use must be at least fi fty percent (50%) of the

value of the decedent’s adjusted gross estate. Use the following worksheet for the calculation.

(a) Fair market value of gross estate ...................................................................................... $

(b) Less: mortgages and liens................................................................................................ (

)

(c) Adjusted gross estate – (a) minus (b) ............................................................................... $

(d) Fair market value of real and personal farm property ....................................................... $

(e) Less: mortgages and liens................................................................................................ (

)

(f) Adjusted value of real and personal farm property – (d) minus (e) ................................... $

.

(g) Ratio of (f) over (c) carried to four decimal places ............................................................ $

5. Twenty-fi ve percent test. The adjusted fair market value of the real farm property (without any adjustment under

R.C. section 5731.011), devoted exclusively to agricultural use must be at least twenty-fi ve percent (25%) of the

value of the decedent’s adjusted gross estate. Use the following worksheet for the calculation.

(a) Adjusted gross estate (from 4(c) above) ........................................................................... $

(b) Fair market value of real farm property ............................................................................. $

(c) Less: mortgages and liens................................................................................................ (

)

(d) Adjusted value of real farm property – (b) minus (c) ......................................................... $

.

(g) Ratio of (d) over (a) carried to four decimal places ........................................................... $

If the farm property satisfi es the requirements of questions 4 and 5, the farm property valuation election may be made.

Part II of this form must be completed if the farm property valuation election is made.

1

1 2

2 3

3 4

4