Reset Form

PR

Rev. 10/14

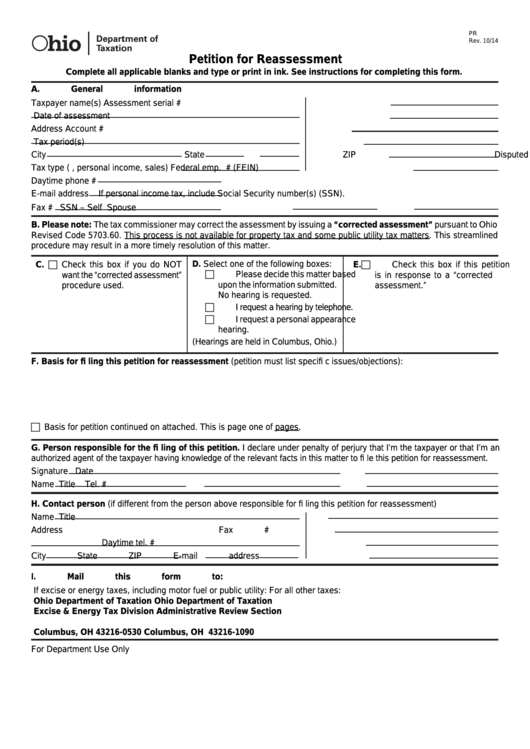

Petition for Reassessment

Complete all applicable blanks and type or print in ink. See instructions for completing this form.

A. General information

Taxpayer name(s)

Assessment serial #

Date of assessment

Address

Account #

Tax period(s)

City

State

ZIP

Disputed amount(s)

Tax type (e.g., personal income, sales)

Federal emp. I.D.# (FEIN)

Daytime phone #

E-mail address

If personal income tax, include Social Security number(s) (SSN).

Fax #

SSN – Self

Spouse

B. Please note: The tax commissioner may correct the assessment by issuing a “corrected assessment” pursuant to Ohio

Revised Code 5703.60. This process is not available for property tax and some public utility tax matters. This streamlined

procedure may result in a more timely resolution of this matter.

D. Select one of the following boxes:

Check this box if this petition

E.

C.Check this box if you do NOT

Please decide this matter based

want the “corrected assessment”

is in response to a “corrected

upon the information submitted.

procedure used.

assessment.”

No hearing is requested.

I request a hearing by telephone.

I request a personal appearance

hearing.

(Hearings are held in Columbus, Ohio.)

F. Basis for fi ling this petition for reassessment (petition must list specifi c issues/objections):

Basis for petition continued on attached. This is page one of

pages.

G. Person responsible for the fi ling of this petition. I declare under penalty of perjury that I’m the taxpayer or that I’m an

authorized agent of the taxpayer having knowledge of the relevant facts in this matter to fi le this petition for reassessment.

Signature

Date

Name

Title

Tel. #

H. Contact person (if different from the person above responsible for fi ling this petition for reassessment)

Name

Title

Address

Fax #

Daytime tel. #

City

State

ZIP

E-mail address

I. Mail this form to:

If excise or energy taxes, including motor fuel or public utility:

For all other taxes:

Ohio Department of Taxation

Ohio Department of Taxation

Excise & Energy Tax Division

Administrative Review Section

P.O. Box 530

P.O. Box 1090

Columbus, OH 43216-0530

Columbus, OH 43216-1090

For Department Use Only

1

1 2

2