General Instructions For Business Allocation Schedule (Form 1065) - 2011

ADVERTISEMENT

__________________________________________2011 Form 1065 _______________________________________ 13

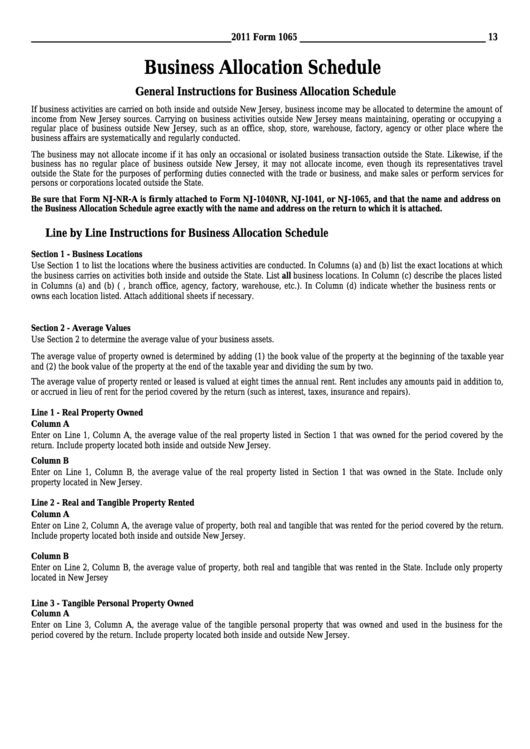

Business Allocation Schedule

General Instructions for Business Allocation Schedule

If business activities are carried on both inside and outside New Jersey, business income may be allocated to determine the amount of

income from New Jersey sources. Carrying on business activities outside New Jersey means maintaining, operating or occupying a

regular place of business outside New Jersey, such as an office, shop, store, warehouse, factory, agency or other place where the

business affairs are systematically and regularly conducted.

The business may not allocate income if it has only an occasional or isolated business transaction outside the State. Likewise, if the

business has no regular place of business outside New Jersey, it may not allocate income, even though its representatives travel

outside the State for the purposes of performing duties connected with the trade or business, and make sales or perform services for

persons or corporations located outside the State.

Be sure that Form NJ-NR-A is firmly attached to Form NJ-1040NR, NJ-1041, or NJ-1065, and that the name and address on

the Business Allocation Schedule agree exactly with the name and address on the return to which it is attached.

Line by Line Instructions for Business Allocation Schedule

Section 1 - Business Locations

Use Section 1 to list the locations where the business activities are conducted. In Columns (a) and (b) list the exact locations at which

the business carries on activities both inside and outside the State. List all business locations. In Column (c) describe the places listed

in Columns (a) and (b) (i.e., branch office, agency, factory, warehouse, etc.). In Column (d) indicate whether the business rents or

owns each location listed. Attach additional sheets if necessary.

Section 2 - Average Values

Use Section 2 to determine the average value of your business assets.

The average value of property owned is determined by adding (1) the book value of the property at the beginning of the taxable year

and (2) the book value of the property at the end of the taxable year and dividing the sum by two.

The average value of property rented or leased is valued at eight times the annual rent. Rent includes any amounts paid in addition to,

or accrued in lieu of rent for the period covered by the return (such as interest, taxes, insurance and repairs).

Line 1 - Real Property Owned

Column A

Enter on Line 1, Column A, the average value of the real property listed in Section 1 that was owned for the period covered by the

return. Include property located both inside and outside New Jersey.

Column B

Enter on Line 1, Column B, the average value of the real property listed in Section 1 that was owned in the State. Include only

property located in New Jersey.

Line 2 - Real and Tangible Property Rented

Column A

Enter on Line 2, Column A, the average value of property, both real and tangible that was rented for the period covered by the return.

Include property located both inside and outside New Jersey.

Column B

Enter on Line 2, Column B, the average value of property, both real and tangible that was rented in the State. Include only property

located in New Jersey

Line 3 - Tangible Personal Property Owned

Column A

Enter on Line 3, Column A, the average value of the tangible personal property that was owned and used in the business for the

period covered by the return. Include property located both inside and outside New Jersey.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3