Reset This Form

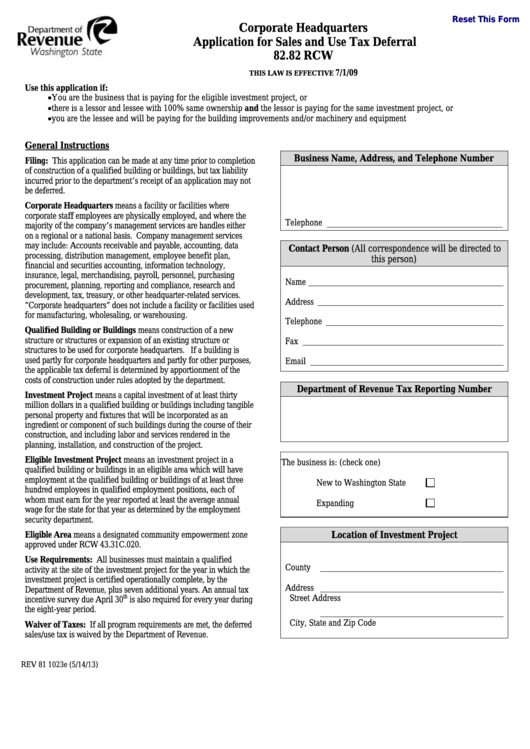

Corporate Headquarters

Application for Sales and Use Tax Deferral

82.82 RCW

7/1/09

THIS LAW IS EFFECTIVE

Use this application if:

You are the business that is paying for the eligible investment project, or

there is a lessor and lessee with 100% same ownership and the lessor is paying for the same investment project, or

you are the lessee and will be paying for the building improvements and/or machinery and equipment

General Instructions

Business Name, Address, and Telephone Number

Filing: This application can be made at any time prior to completion

of construction of a qualified building or buildings, but tax liability

incurred prior to the department’s receipt of an application may not

be deferred.

Corporate Headquarters means a facility or facilities where

corporate staff employees are physically employed, and where the

Telephone ________________________________________

majority of the company’s management services are handles either

on a regional or a national basis. Company management services

may include: Accounts receivable and payable, accounting, data

Contact Person (All correspondence will be directed to

processing, distribution management, employee benefit plan,

this person)

financial and securities accounting, information technology,

insurance, legal, merchandising, payroll, personnel, purchasing

Name

procurement, planning, reporting and compliance, research and

development, tax, treasury, or other headquarter-related services.

Address

“Corporate headquarters” does not include a facility or facilities used

for manufacturing, wholesaling, or warehousing.

Telephone

Qualified Building or Buildings means construction of a new

structure or structures or expansion of an existing structure or

Fax

structures to be used for corporate headquarters. If a building is

used partly for corporate headquarters and partly for other purposes,

Email

the applicable tax deferral is determined by apportionment of the

costs of construction under rules adopted by the department.

Department of Revenue Tax Reporting Number

Investment Project means a capital investment of at least thirty

million dollars in a qualified building or buildings including tangible

personal property and fixtures that will be incorporated as an

ingredient or component of such buildings during the course of their

construction, and including labor and services rendered in the

planning, installation, and construction of the project.

Eligible Investment Project means an investment project in a

The business is: (check one)

qualified building or buildings in an eligible area which will have

employment at the qualified building or buildings of at least three

New to Washington State

hundred employees in qualified employment positions, each of

whom must earn for the year reported at least the average annual

Expanding

wage for the state for that year as determined by the employment

security department.

Eligible Area means a designated community empowerment zone

Location of Investment Project

approved under RCW 43.31C.020.

Use Requirements: All businesses must maintain a qualified

County

activity at the site of the investment project for the year in which the

investment project is certified operationally complete, by the

Address

Department of Revenue, plus seven additional years. An annual tax

th

Street Address

incentive survey due April 30

is also required for every year during

the eight-year period.

City, State and Zip Code

Waiver of Taxes: If all program requirements are met, the deferred

sales/use tax is waived by the Department of Revenue.

REV 81 1023e (5/14/13)

1

1 2

2 3

3