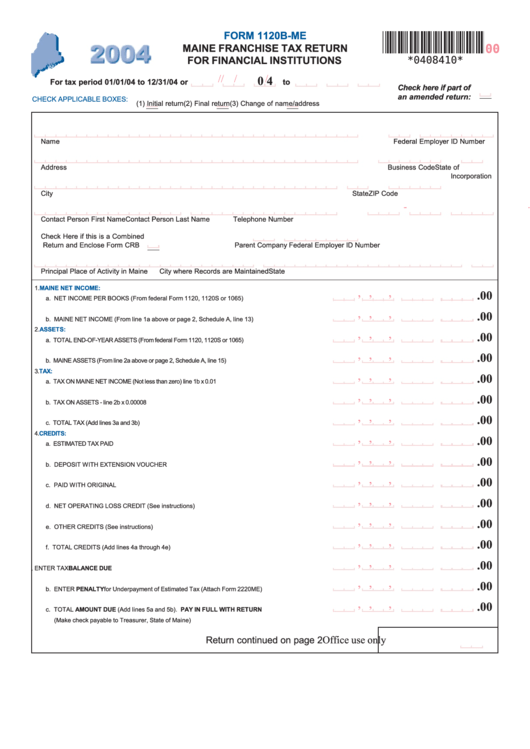

Form 1120b-Me - Maine Franchise Tax Return For Financial Institutions - 2004

ADVERTISEMENT

FORM 1120B-ME

MAINE FRANCHISE TAX RETURN

00

FOR FINANCIAL INSTITUTIONS

*0408410*

/

/

/

/

0 4

For tax period 01/01/04 to 12/31/04 or

to

Check here if part of

an amended return:

CHECK APPLICABLE BOXES:

(1)

Initial return

(2)

Final return

(3)

Change of name/address

Name

Federal Employer ID Number

Address

Business Code

State of

Incorporation

City

State

ZIP Code

-

-

Contact Person First Name

Contact Person Last Name

Telephone Number

Check Here if this is a Combined

Return and Enclose Form CRB

Parent Company Federal Employer ID Number

Principal Place of Activity in Maine

City where Records are Maintained

State

1.

MAINE NET INCOME:

,

,

,

.00

a. NET INCOME PER BOOKS (From federal Form 1120, 1120S or 1065) ............................................. 1a

,

,

,

.00

b. MAINE NET INCOME (From line 1a above or page 2, Schedule A, line 13) ....................................... 1b

2.

ASSETS:

,

,

,

.00

a. TOTAL END-OF-YEAR ASSETS (From federal Form 1120, 1120S or 1065) .............................................. 2a

,

,

,

.00

b. MAINE ASSETS (From line 2a above or page 2, Schedule A, line 15) ........................................................ 2b

3.

TAX:

,

,

,

.00

a. TAX ON MAINE NET INCOME (Not less than zero) line 1b x 0.01 ............................................................. 3a

,

,

,

.00

b. TAX ON ASSETS - line 2b x 0.00008 ....................................................................................................... 3b

,

,

,

.00

c. TOTAL TAX (Add lines 3a and 3b) ........................................................................................................... 3c

4.

CREDITS:

,

,

,

.00

a. ESTIMATED TAX PAID .......................................................................................................................... 4a

,

,

,

.00

b. DEPOSIT WITH EXTENSION VOUCHER ......................................................................................... 4b

,

,

,

.00

c. PAID WITH ORIGINAL RETURN ......................................................................................................... 4c

,

,

,

.00

d. NET OPERATING LOSS CREDIT (See instructions) ......................................................................... 4d

,

,

,

.00

e. OTHER CREDITS (See instructions) ................................................................................................. 4e

,

,

,

.00

f. TOTAL CREDITS (Add lines 4a through 4e) ......................................................................................... 4f

,

,

,

.00

5. a. IF LINE 3c IS GREATER THAN LINE 4f, ENTER TAX BALANCE DUE ............................................ 5a

,

,

,

.00

b. ENTER PENALTY for Underpayment of Estimated Tax (Attach Form 2220ME) ................................. 5b

,

,

,

.00

c. TOTAL AMOUNT DUE (Add lines 5a and 5b). PAY IN FULL WITH RETURN .................................... 5c

(Make check payable to Treasurer, State of Maine)

Office use only

Return continued on page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2